Table of Contents

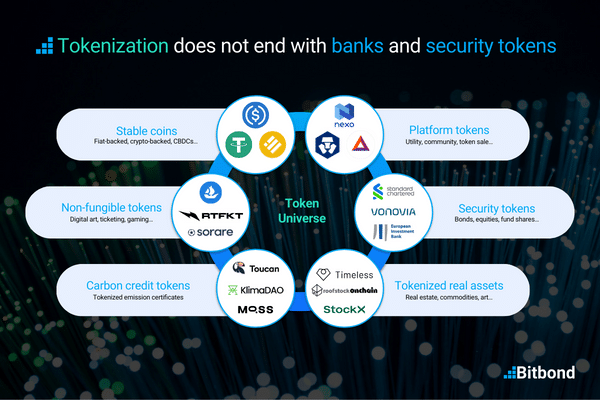

Tokenization has been hailed as a revolutionary breakthrough in the world of finance, bringing the benefits of blockchain technology to traditional assets. With the help of tokenization, assets can be converted into digital tokens making them easily traded, transferred and managed using Distributed Ledger Technology.

These tokens can represent a range of assets, from stocks and bonds to commodities, real estate and even art & collectibles. Disrupting all kinds of markets and industries, many use cases can drastically benefit from tokenization. Other than bringing significant efficiency gains to processes in general, it also offers potential to create new revenue streams from assets that were previously left out of the investment scope.

This article will provide an overview of some of the top tokenization use cases.

Tokenization use cases for Financial Assets

Check out our Tokenization Use Cases Bible (download here):

Tokenization of bonds, stock, and shares

Tokenization of financial assets such as bonds, stocks, and shares, enables the fractionalization of these assets. As a result, their accessibility to investors is significantly increased. The tokens can be traded on a decentralized network which oftentimes makes it cheaper, faster and more secure than traditional methods of exchanging assets.

This opens up the possibility of a new era of democratized investment, with investors from all over the world being able to take part in investment opportunities that were previously only available to a select few.

On-chain support for the full life-cycle of these financial securities is possible, enabling near real-time on-chain settlement of primary issuance, coupon payouts, and/or dividend redemption. Benefits include fractional trading of bonds, stock, and shares, leading to a larger liquidity pool and a broader range of investors. Additionally, tokenization use cases for financial assets supports efficient processing of daily issuances, increases secondary liquidity through more investors, and reduces costs such as fees charged by the Central Securities Depository (DSD).

Tokenization of funds

Tokenization use cases for funds apply along the entire value chain and support a full lifecycle to fractionalized investments. A better portfolio diversification is made possible alongside lower transaction costs. Fund managers benefit from greater flexibility and control in distribution of assets as well as:

- Realize operational efficiency gains

- Easier access for investors with a global reach through fractionalization. Lower barriers to entry, better price discovery, and deeper/improved liquidity.

- Lower costs of issuance and servicing through digitization. Easier to track and service investors, and allows built-in compliance.

- Near instant and low-cost transfers and settlement programmed through smart contracts. Basically, rule based actions with lower likelihood of errors including on-chain order book management can be embedded within the financial asset.

- Increased market value of previously illiquid assets by 30%-40% as illiquidity premiums vanish. Also, benefits from the advantages of relatively illiquid investments without having to bear the risk of long holding periods.

The type of Funds that can benefit from this tokenization use case are:

- Mutual funds

- Investment funds

- Hedge funds

- Private equity funds

- Venture capital funds

- Private debt funds

Tokenization use case for Stablecoins

Stablecoins are cryptocurrencies that are pegged to the value of a stable asset, such as the US dollar, and are designed to reduce the volatility associated with other cryptocurrencies. Tokenization has allowed for the creation of stablecoins, which are particularly useful for facilitating cross-border payments and remittances. By using stablecoins, businesses and individuals can avoid the currency fluctuations and high transaction fees associated with traditional methods of sending money abroad.

Benefits:

- Internalize payments

- New revenue opportunities through yield generation (interest on deposits)

- Enable new payments related use cases

- Enable on chain DVP settlements with other tokenized assets

Tokenization for payment settlement

DvP (Delivery vs. Payment) settlement between a tokenized asset and stable coin. The DvP settlement of token-based securities / financial asset transactions can take place automatically and simultaneously, without the involvement of an additional intermediary. Typically a dedicated DvP smart contract is used.

Benefits:

- Real-time settlement

- No settlement risk / counterparty risk from settlement

- Cost reduction

- Independence over intermediaries like CSDs

Tokenization use case for Real Estate

Tokenization of real estate assets involves converting ownership rights into digital tokens on a blockchain network. This allows for fractional ownership and more efficient transfer of ownership. Tokenization also provides greater transparency, reduces transaction costs, and eliminates intermediaries, making it easier for a wider pool of investors to participate in real estate investments. The creation of a digital representation of real estate assets also allows for easier trading on global markets, providing a more secure and streamlined approach for fundraising and investment in real estate projects. Real estate tokenization has the potential to revolutionize the traditional real estate investment landscape.

Tokenization use case for Digital Art

Other popular tokenization use cases are for tokenizing artwork. The world of digital art is growing rapidly, and tokenization is playing a key role in this growth. By converting digital art into NFT tokens, ownership and provenance of the art can be securely tracked and verified on a blockchain platform. This not only helps to reduce fraud and counterfeiting, but it also opens up new opportunities for artists to monetize content and for collectors to invest in the growing digital art market. Learn how to create an NFT in just a few minutes.

Tokenization use case for Entry Tickets

Tokenization of entry tickets has the potential to revolutionize the events industry. By converting entry tickets into digital tokens, event organizers can reduce the costs associated with printing and distributing physical tickets, while at the same time providing a secure and convenient way for attendees to access their event. This also opens up the possibility of secondary markets for event tickets, where tickets can be traded and resold, providing additional revenue streams for event organizers.

Tokenization use case for Loyalty Programs

Tokenization of loyalty programs has the potential to bring a new level of transparency and security to this sector. By converting loyalty points into tokens, loyalty programs can be managed on a blockchain platform, providing a secure and transparent record of each customer’s loyalty points balance. This not only helps to reduce fraud, but it also makes it easier for customers to manage and redeem their loyalty points, bringing a new level of convenience to the sector.

Tokenization use case for Certifications

Tokenization of certifications has the potential to revolutionize the way that we verify and manage credentials. By converting certifications into tokens, they can be securely stored on a blockchain platform, providing a secure and tamper-proof record of each individual’s certifications. This opens up new opportunities for individuals and organizations to verify and manage credentials in a more efficient and secure manner.

Tokenization use case for Digital Twins

Tokenization of digital twins has the potential to revolutionize the way that we manage and monetize digital assets. Digital twins are digital representations of physical assets, and tokenization allows these assets to be managed and traded on a blockchain platform. This opens up new opportunities for businesses to monetize their digital assets, providing new revenue streams and reducing costs associated with the management of these assets.

Tokenization is the way forward

Lead your tokenization use case without any complexities

In conclusion, tokenization has the potential to revolutionize a wide range of industries. It also opens up the opportunity for new revenue streams giving issuers more control and flexibility over their offerings.

However, with new technologies arise new challenges. Expertise around tokenization is still scarce and the knowledge is not widely available. This can prove to be quite challenging for anyone looking to leverage and unleash the full potential of such innovation.

At Bitbond, we’re true believers in all tokenization use cases, there are tremendous benefits that the public can take advantage of to improve financial inclusion. Using our tokenization platform Token Tool, anyone can start their journey into tokenization without complexities. Industry proven solutions with robust security standards are at the reach of your fingertips.

Simply configure your tokens using our user-friendly Web3 application, pay for the fees, and get tokenizing. All without writing a single line of code.

Start tokenizing today with Token Tool. Learn how easy it is to tokenize assets using Bitbond Token Tool in the demo guide below: