Table of Contents

Introduction to ERC 1400 Token

The financial landscape is rapidly evolving with the integration of blockchain technology, particularly through the use of ERC 1400 tokens in security token offerings (STOs).

These tokens standardize the investment contracts on the blockchain, ensuring they comply with legal regulations and facilitate automated transactions. Bitbond’s Token Tool significantly simplifies the creation and management of these tokens, embodying precision, compliance, and ease of use.

What is an ERC 1400 Token?

ERC 1400 tokens are advanced digital assets on the Ethereum blockchain and any EVM-compatible blockchain, designed to adhere to strict regulatory standards, making them ideal for formal and structured finance. Unlike other tokens which may serve more general purposes, ERC 1400 tokens are specifically crafted to function as security tokens that comply with legal governance and regulatory statutes.

Advantages of Using ERC 1400 Tokens

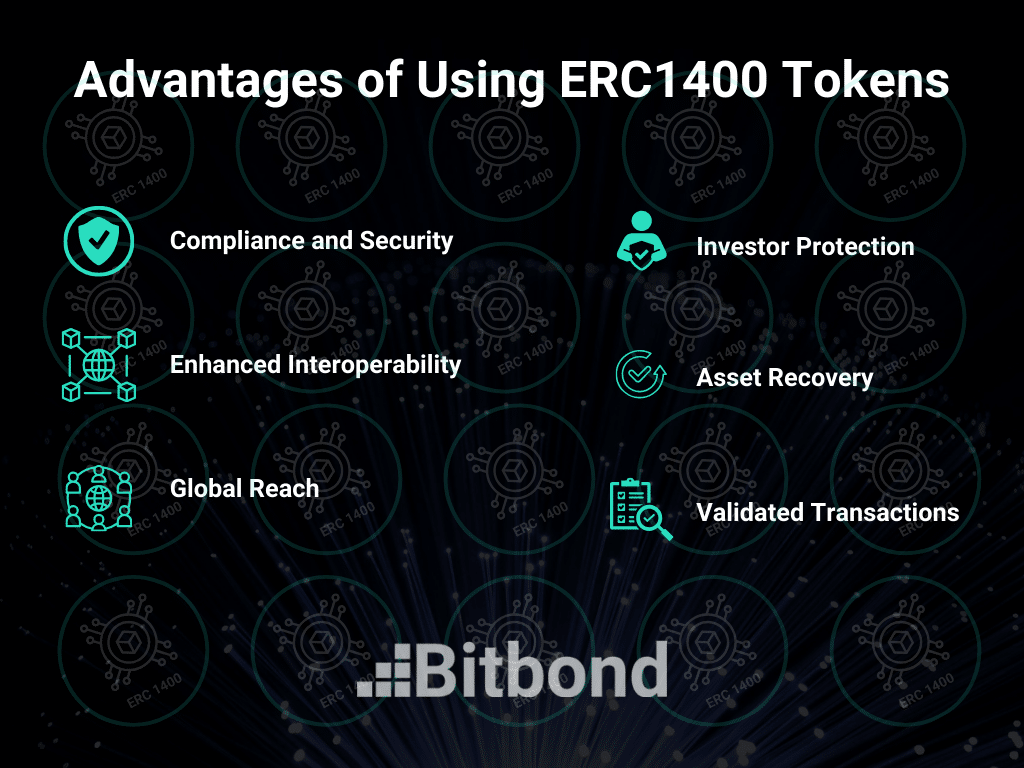

ERC 1400 tokens bring a wealth of benefits tailored to enhance security, interoperability, and compliance, which are crucial for businesses aiming to leverage blockchain technology for secure and regulated token offerings.

Here are the detailed benefits:

- Comprehensive Compliance and Security

ERC 1400 tokens are designed to comply with stringent security standards, ensuring that all transactions adhere to the set regulations which greatly mitigates the risk of legal challenges. They incorporate advanced transfer restrictions and real-time status checks, providing a robust framework that enhances investor confidence and security. This compliance is critical in fostering trust and stability in investments, making ERC 1400 tokens a reliable option for security token offerings (STOs). Token issuers can enforce compliance rules, such as investor accreditation and transfer restrictions. This ensures that security tokens are issued and traded in accordance with legal requirements.

Real-world Example:

The maritime industry, known for its complexity and diversity, spans shipping, port management, and maritime services. It faces numerous challenges such as the need for robust documentation, efficient tracking of cargo and vessels, and effective supply chain management. The ERC-1400 protocol addresses these issues by enabling the issuance and trading of security tokens that represent tangible assets within the sector, such as ships and cargo. This capability significantly streamlines transactions, cuts down on paperwork costs and duration, and enhances transparency concerning asset ownership.

- Enhanced Interoperability

One of the standout features of ERC 1400 tokens is their high level of interoperability, which allows them to function seamlessly with various other tokens and smart contracts on the Ethereum network. It is designed to work seamlessly with other Ethereum-based standards, such as ERC-20 and ERC-721. This interoperability facilitates the integration of security tokens into existing blockchain ecosystems, exchanges, and wallets, making them more accessible and liquid.

This in turn opens up numerous possibilities for businesses to integrate these tokens into different parts of their operations, thereby enhancing the overall efficiency and reach of their business practices.

- Global Reach and Capital Efficiency

With regulatory compliance built in, the ERC 1400 standard simplifies the process of raising capital globally through STOs. It extends the reach of businesses by providing them with the tools to conduct offerings that are accessible by investors worldwide, thus broadening the potential investor base and increasing the exposure of the business.

- Investor Protection through Partial Ownership

ERC 1400 tokens allow investors to attain partial ownership of the underlying assets or projects. This feature not only democratizes investments but also provides a layer of security for token holders, as it restricts the transfer of ownership without consent, protecting investors from potential dilution of value or fraudulent activities.

- Asset Recovery Options

Another significant advantage of the ERC 1400 standard is the facilitation of asset recovery. The tokens are equipped with mechanisms such as reverse or forced transfers, which can be initiated in case of an erroneous transaction or if recovery is required by law. This capability is essential for minimizing losses and providing a safety net for token holders.

- Secured and Validated Transactions

Transactions involving ERC 1400 tokens require the approval of token holders, which means that both on-chain and off-chain transactions are validated through consensus. This not only enhances the security of transactions but also ensures that all parties are in agreement, thus maintaining integrity and trust throughout the transaction process.

These features make ERC 1400 tokens an excellent choice for businesses looking to issue security tokens that are not only compliant with international regulations but also offer enhanced liquidity, security, and investor protection.

Let’s now take a closer look at the legal considerations.

Understanding the Regulatory Framework of ERC 1400

Obtaining SEC Approval

Securing approval from the U.S. Securities and Exchange Commission (SEC) is a critical step before issuing any ERC 1400 tokens, which are considered security tokens. This approval is crucial because it ensures that your tokens comply with U.S. securities laws, protecting both the issuer and the investor from potential legal complications. Here’s how to navigate the SEC approval process effectively:

- Understanding SEC Regulations

Before beginning the token creation process, it is vital to understand the specific SEC regulations that apply to security tokens. These might include rules regarding investor protection, anti-money laundering (AML), and Know Your Customer (KYC) protocols.

- Preparing the Necessary Documentation

To apply for SEC approval, prepare a detailed prospectus that includes the business model, operational plan, financials, the technology behind the tokens, and the risks involved. This document should be thorough as it will be scrutinized during the approval process.

- Filing with the SEC

Once your documentation is ready, file it with the SEC. This will involve filling out several forms that describe the token offering in detail and how it complies with regulatory standards.

- Awaiting Approval

After submission, there will be a waiting period during which the SEC reviews your application. During this time, they may request additional information or clarifications, so be prepared to respond promptly.

- Receiving Approval

If the SEC approves your application, you’ll receive formal documentation allowing you to proceed with issuing your tokens. If denied, you’ll receive feedback on necessary changes to become compliant.

- Using Bitbond Token Tool

With SEC approval in hand, use Bitbond’s Token Tool to create your ERC 1400 tokens confidently. The tool simplifies compliance with built-in regulatory features, ensuring your tokens meet all legal standards from the outset.

Using Bitbond Token Tool for ERC 1400

Bitbond Token Tool provides an all-in-one platform to create, manage, and analyze ERC 1400 tokens efficiently. Here’s how you can use this tool to your advantage:

- Simplified Creation Process: Token Tool offers a user-friendly interface that guides you through the creation of your security token, from defining its characteristics to setting up its compliance features.

- Automated Compliance: Ensure your token adheres to relevant regulations with compliance checks, which significantly mitigate the risk of errors and non-compliance.

- Seamless Management: Manage your tokens effectively using the Token Tool’s dashboard, which allows seamless lifecycle management

Step-by-Step Guide to Creating an ERC 1400 Token

- Preparation: Understand the legal implications and gather all necessary information about your offering.

- Define Token Characteristics: Use the Token Tool to specify your token’s features, including total supply, token name, and special attributes based on your needs.

- Develop Smart Contracts: Leverage the Token Tool integrated smart contract generator to create compliant and secure contracts without needing deep technical expertise.

- Deploy and Manage: Once set up, deploy your tokens directly on the network using the tool, sparing you from any complexities. You can then use the manage function to take actions on your tokens as regulations and business needs evolve.

It is worth mentioning that smart contracts cannot be changed after deployment. Therefore, the process must be done with high attention to detail.

Real-World Applications for ERC 1400

From real estate to fine art, ERC 1400 tokens are revolutionizing asset management and investment opportunities. Token Tool by Bitbond makes these advancements accessible to businesses of all sizes, enabling them to leverage blockchain technology for asset tokenization with unprecedented ease and security. You can learn more about how with the help of tokenization, assets can be converted into digital tokens making them easily traded, transferred, and managed using Distributed Ledger Technology.

Conclusion

Creating ERC 1400 tokens can be a complex process, but with Bitbond Token Tool, it becomes straightforward and compliant. This tool not only assists in the technical creation of tokens but also ensures you’re enabled with the means to meet all necessary legal standards, simplifying the path to launching your security token offering.

FAQs

What is the difference between ERC20 and ERC1400?

ERC 20 tokens are digital currencies used typically for ICOs and do not necessarily comply with regulatory requirements for securities, whereas ERC 1400 tokens are specifically designed as compliant security tokens, integrating legal compliance measures into their structure.

How does Token Tool simplify the creation of ERC1400 tokens?

Token Tool provides a user-friendly interface and comprehensive tools that guide users through the token creation process, including the legal and technical aspects, making it easier to ensure compliance and functionality.

What are the legal implications of creating a security token?

The creation of security tokens involves stringent regulatory requirements, including adherence to local securities laws, anti-money laundering (AML) regulations, and Know Your Customer (KYC) protocols.