Table of Contents

What is an STO?

A Security Token Offering (STO) allows a firm to raise capital for business projects by creating and issuing a new security token to investors. The mechanisms of an STO is similar to an Initial Public Offering (IPO), however, the investment and exchange of assets takes place on blockchain technology rather than on the traditional market infrastructure.

In contrast to ICOs, STOs offer more secure, and transparent direct investments in a company due to security tokens requiring extensive regulation. Security tokens are considered like traditional securities, meaning that they fall under the same regulatory requirements as electronic securities and must be asset-backed security tokens. Therefore, STOs combine the technology of blockchain with the requirements of regulated securities markets.

STOs involve the creation of digital tokens that either run on an existing network, for example Ethereum, or on a specially created blockchain. Security tokens are similar to analog securities and are asset-backed. Thus, they are a digital representation of ownership of real-world assets such as real estate or corporate stock.

STO vs ICO vs IDO

STO vs ICO

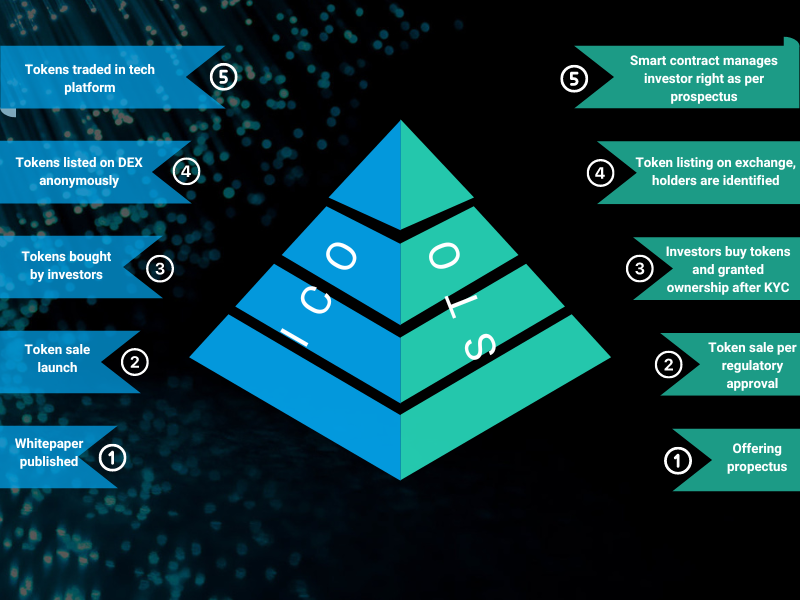

The fundamental idea behind Initial Coin Offerings (ICOs), was to issue a digital asset that can be used within an ecosystem that has yet to be built. The proceeds from the ICO will then be used to develop the platform. Compared to STOs, the market of Initial Coin Offerings (ICOs) is unregulated and the issuer must manage all the responsibilities. Thus, ICOs are more flexible but also riskier than STOs.

The structure of an ICO can either be a static or a dynamic pool. Static pools have a pre-set price and quantity, whereas for dynamic pools either the price or the quantity is set. A whitepaper is issued to provide investors with information on the ICO structure and project details. On the other hand, in most jurisdictions, an STO requires a prospectus that must be approved by the financial authorities ahead of the issuance.

Moreover, the tokens issued are usually not asset-backed and therefore their value is dependent on the developments of the underlying project. Consequently, token holders benefit from participating in ICOs if their tokens achieve a higher valuation in secondary markets.

Ethereum’s fundraising process in 2014 is an early example for a successful ICO. Investors received ether (ETH) in exchange for bitcoin (BTC) and approximately $2.2 million were raised in the first 12 hours. After 42 days, by the end of the sale, more than 50 million ETH were sold, amounting to around $17.2 million.

STO vs IDO

Initial Dex Offerings (IDO) are crypto token offerings running on a Decentralized Exchange (DEX). In order to raise capital, the crypto project provides their tokens to the DEX at a fixed price. Users will then commit their funds through the platform. After receiving their tokens during the Token Generation Event (TGE), investors can trade their tokens.

Similar to STOs, IDO processes are automated and facilitated by smart contracts. However, for IDOs DEXs have a primary role in the issuance and auditing process. The selected decentralized exchange handles the investors’ funds, creates the smart contracts and then lists the tokens by creating a liquidity pool.

Types of security tokens

Equity tokens

Equity tokens are similar to traditional shares as they contain the same information as a physical share certificate. The primary difference is that the information of equity tokens is recorded on the blockchain rather than in a share register. Just like shareholders, equity token holders are entitled to a share of the company’s profits and voting rights. From a regulatory point of view, it is still not completely clear how it is possible to structure an issuance of equity tokens within currently available legal frameworks.

Debt Tokens

Debt tokens are similar to short-term loans and represent debt instruments such as real estate mortgages, and/or corporate bonds. The information of the debt issuance is stored on the blockchain by creating a smart contract. The two primary types of debt tokens are stable debt tokens, and variable debt tokens, depending on the interest rate structure.

Asset-backed Tokens

Asset-backed tokens are a digital claim on a physical asset. Therefore, they represent real-world assets such as gold, real estate, or art. It allows investors to buy such assets without physically storing or exchanging them. Moreover, asset-backed tokens retain value so the token itself is a digital asset.

Advantages of STOs

For issuers, STOs are an opportunity to trade assets online and to benefit from blockchain technology in order to generate liquidity. As there is no need for legal counsel through the use of smart contracts, issuers also profit from lower administrative costs. Thus, the possibility to raise funds beyond traditional fundraising channels is particularly important for small business ventures.

The fractionalization of ownership allows investors to address a larger number of investors and enables the creation of investment pools. Asset owners can thus partially sell their assets whilst keeping the majority of tokens. Moreover, issuers can transform illiquide tangible assets into tradable assets which enables further fundraising. For investors, fractional ownership allows an additional possibility for portfolio diversification and trading, hence getting access to a broader set of investment possibilities that weren’t available prior.

Security tokens are pegged to a real-world asset, therefore, it is easier for a potential investor to evaluate the project. As records of ownership and project details are permanently and securely stored on the blockchain, investors can take advantage of more transparent information on the underlying asset. Additionally, STOs are regulated similar to any other security investment and thus guarantee higher investor protection.

Risks of STOs

As security tokens are regulated like any other security, legal expertise is required to deal with the complex regulatory framework.To guarantee compliance with local securities regulation, the legal expert should be covering the region that you want to issue your token in.

Additionally, a platform is necessary to issue the tokens and to manage the pre-sale. It is important to rely on a trusted partner to deal with the technological framework in order to avoid compliance and technical issues. Token Tool by Bitbond can for example be used to easily mint your own token and to set up and manage an STO.

Technological risks are of course always present, examples can be the blockchain being compromised, or hacks completed through social engineering. The latter has proven to be riskier than the former as blockchain has been proving to be highly robust in terms of IT safety and security.

Examples STOs

Bitbond conducted the first STO with a BaFin approved securities prospectus in Germany in 2019. The BB1 token was issued by Bitbond Finance which is a subsidiary of Bitbond. The token created represents a corporate bond of Bitbond that issues 1% interest on the invested amount every quarter and additionally pays a variable coupon based on the profits of Bitbond Finance. The capital raised was used to further drive the growth of Bitbond activities through the financing of working capital to the entity.

The multinational Singapore-based bank DBS issued a fully digitalized S$15 million ($11.3) bond in a STO in May 2021. The bond is traded in lots of S$10,000 ($7,600) and has a six month tenor and pays 0.6% per annum. Similar to the Bitbond STO, the token issued by DBS complies with the same legal requirements and protections as traditional bonds

Create an STO in minutes

Using Token Tool, users can easily create an STO in just a few clicks. No need to deal with the lack of technical know-how related to developing products on blockchain technology. It is a user-friendly interface, allowing users to leverage the potential of blockchain and tokenization, without needing to write a single line of code.

Simply go to Create Token Sale on Token Tool, fill in the parameters for your STO, and start your offering. Prior to launching your token offering, you will need to ensure that you have a token available to be sold. You can easily Create Token using Token Tool as well.

Check out this guide on how to create a token sale for a more detailed step by step process.