Table of Contents

Unleashing the Power of Real Estate Token

What Are Real Estate Tokens?

Real estate tokens represent a paradigm shift in property investment. These digital shares of property ownership use blockchain technology to democratize access to real estate markets, which have traditionally been characterized by high entry barriers.

Blockchain as the Technological Backbone

Blockchain technology serves as the foundation for real estate tokens. It ensures immutable records and transparent transactions, making real estate investments more secure and efficient. This technological foundation not only makes real estate investments more secure but also more efficient, reducing the transactional costs and complexities traditionally associated with real estate.

The Rise of Real Estate Tokenization

A New Era in Property Management

Tokenized real estate marks a significant shift from traditional property management methods, introducing efficiencies that streamline transactions and expand market access. This new era offers investors flexibility, reduced overheads, and a broader marketplace that transcends geographical boundaries.

Key Drivers of Real Estate Tokenization

The adoption of real estate tokens is driven by several factors including global market trends and evolving regulatory environments that increasingly support technological innovations. These drivers facilitate the integration of real estate into the digital economy, making investments more accessible and liquid.

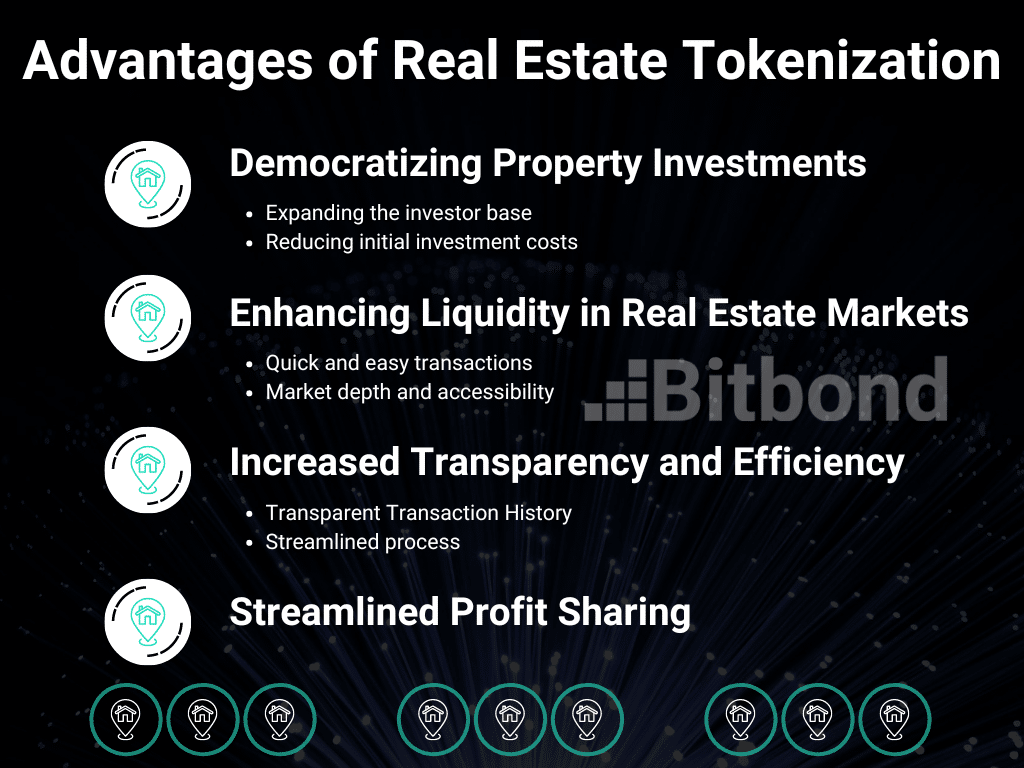

Advantages of Real Estate Tokens

Democratizing Property Investments

Tokenization of assets, and specifically real estate, reduces financial barriers to entry, making property investment feasible for a wider audience. This democratization process benefits the real estate market by:

- Expanding the Investor Base: It opens the market to small-scale investors worldwide, which enhances liquidity and market activity.

- Reducing Initial Investment Costs: Investors can buy real estate tokens that represent fractions of property, allowing them to own shares of real estate at much lower costs than traditional real estate investments.

Enhancing Liquidity in Real Estate Markets

Tokenization significantly enhances the liquidity of real estate investments, transforming real estate into a more freely tradable asset class. The key benefits include:

- Quick and Easy Transactions: Tokens can be bought and sold on digital exchanges almost instantly, which is not the case with traditional real estate.

- Market Depth and Accessibility: Increased liquidity attracts more investors, which deepens the market and improves asset valuation accuracy.

Increased Transparency and Efficiency

The blockchain’s role in real estate tokenization greatly increases the transparency and efficiency of transactions:

- Transparent Transaction History: Each token transaction is recorded on a blockchain, providing a clear, unchangeable history that enhances trust among investors.

- Streamlined Processes: The automation of transactions and use of smart contracts eliminate the need for middlemen, which reduces fees and speeds up processes.

Simplified Profit Sharing

Tokenization streamlines the distribution of profits from property investments. When properties generate income, whether through rental earnings or sales, the profits can be automatically divided among token holders through smart contracts. This process ensures that all investors receive their share of the profits directly to their digital wallets, proportional to their investment, without the need for manual distribution or the involvement of traditional banking systems.

Exploring Bitbond’s Role in Real Estate Tokenization

Features of the Token Tool While exploring the benefits of real estate tokenization, it’s worth noting platforms like Token Tool by Bitbond, which provide an easy-to-use interface to create your smart contracts and provide secure and efficient services for managing real estate tokens subtly. All without the need for prior blockchain or technical expertise.

Real Estate Tokenization vs. Traditional Methods

| Traditional Real Estate | Tokenized Real Estate | |

|---|---|---|

| Capital Requirement | High ($50K-$100K) | Low (In the hundreds of $) |

| Expertise | Required: Managing property requires expertise | Not Required: Sponsors provide the expertise needed |

| Transaction Cost & Time | High (Transaction costs maybe 5-10% of total cost) | Low (Transaction Costs are 1-3% of total cost) |

| Liquidity | Low (Doesn’t sell fast) | High ( investors benefit from greater market liquidity without sacrificing value) |

| Market Visibility | Fragmented | Global |

| Proof of Ownership | Insecure (Piece of Paper) | Secure (Stored on a Public Blockchain) |

| Property Specificity | Low (Invest in Funds and not individual properties) | High (Real estate tokens are specific to particular properties). |

| Legal Restrictions | Manual (Specific to region) | Automatic (Smart Contracts automate legal compliance) |

Potential Challenges and Strategic Solutions

Adopting real estate tokens also involves challenges such as regulatory compliance and market acceptance. It is important to select the right strategic partner which provides the necessary know-how and expertise ensuring the security and legality of transactions. Strategic solutions provided by specialized partners such as Bitbond help navigate these issues effectively.

Legal Framework and Compliance Issues

Navigating the Regulatory Environment

The regulatory framework for real estate tokens is complex and ever-changing. Investors need a thorough understanding of these regulations to ensure compliance and secure their investments.

Ensuring Compliance in Token Transactions

Compliance is crucial in token transactions. Utilizing platforms that prioritize legal compliance can safeguard investors from potential legal challenges and enhance the investment’s security.

Getting Started with Real Estate Tokens

Choosing the Right Platform

A tokenization platform offers Tokenization-as-a-Service and thus allows users to create tokens of different token standards. Users can easily issue digital tokens on blockchain, without the necessity to be proficient in smart contract programming. In addition to token creation functions, tokenization platforms also provide lifecycle management services for your tokens.

The selection of a tokenization platform is crucial. A platform that balances ease of use with comprehensive knowledge of regulatory compliance, like Token Tool by Bitbond, can significantly influence the success of an investment.

Investment Strategies for Token Holders

Investors should consider diverse strategies when entering the tokenized real estate market:

- Portfolio Diversification: Spreading investments across various properties to mitigate risks.

- Assessing Investment Horizons: Understanding whether short-term gains or long-term appreciation is the investment goal.

Conclusion

Real estate tokenization is revolutionizing the way we invest in properties, making it more accessible, liquid, and efficient. For those looking to explore this innovative form of investment, platforms that facilitate easy management and compliance will be crucial in navigating this new landscape.

Real Esate Token FAQs

- How do real estate tokens work and what are their benefits? Real estate tokens facilitate easier, more transparent, and more efficient property investments than traditional methods.

- What technological foundations support real estate tokenization? Blockchain technology underpins real estate tokenization, providing the infrastructure necessary for secure and transparent transactions.

- What legal considerations do investors need to keep in mind? Understanding and adhering to the regulatory environment is crucial for anyone looking to invest in real estate tokens to avoid potential legal issues.