Table of Contents

What is a tokenization platform?

A tokenization platform offers Tokenization-as-a-Service and thus allows users to create tokens of different token standards. Users can easily issue digital tokens on blockchain, without the necessity to be proficient in smart contract programming. In addition to token creation functions, tokenization platforms also provide lifecycle management services for your tokens.

Institutional and retail investors, as well as financial institutions, use asset tokenization platforms to monitor, issue, and manage their investments. Once assets are tokenized, they can be used for global transactions without the need for an intermediary. Therefore, users can create liquidity for asset classes of all kinds on a global scale using a tokenization provider.

What is asset tokenization?

Asset tokenization refers to the process of issuing security tokens that represent real tradable assets. It is possible to tokenize any assets including VC funds, collectables, physical goods, real estate, precious metals, and intellectual property. Tokenization is often mistaken for securitization. Whereas securitization involves pooling illiquid asset classes and repackaging them into securities, asset tokenization converts real world assets into digital tokens.

Benefits of using an asset tokenization platform

The primary advantage of using a tokenization platform is that users can benefit from the opportunities of asset tokenization. Advantages of asset tokenization in general are primarily improved liquidity, cost savings, real time transactions, transparency, and immutability.

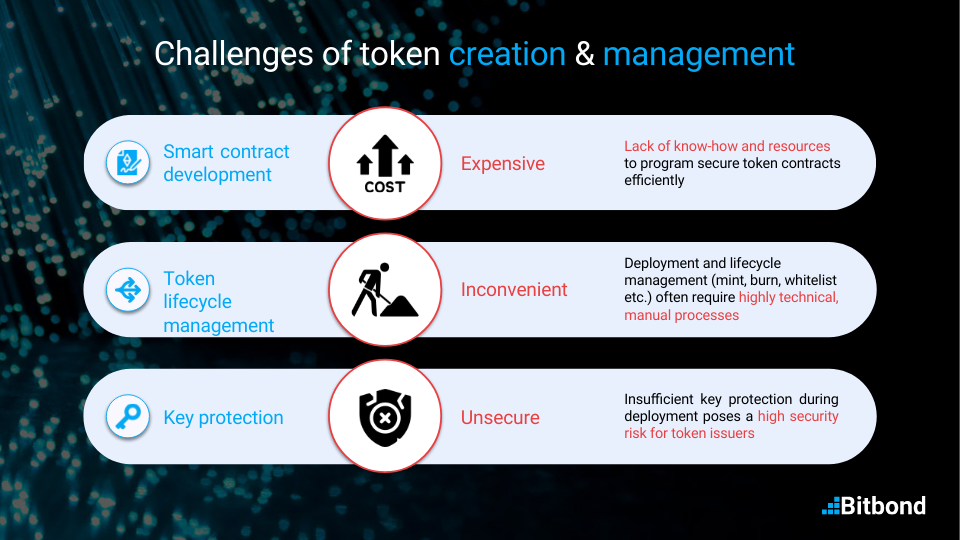

The central benefits of using an asset tokenization platform for the issuance and management of tokens are smart contract security, no programming skills are required, and efficiency. As Token Tool’s smart contracts are audited by Certik, there are fewer risks of coding errors. Moreover, all functionalities of Token Tool can be easily used by users without being proficient in technical know-how. Due to the user friendliness of tokenization platforms such as Token Tool, crypto tokens can be issued within minutes, making the process very efficient.

Additionally, organizations that aim at using asset tokenization but lack technical knowledge can use asset tokenization platforms to effortlessly create, distribute, and sell their tokens. No technical integration is needed for web3 tokenization platforms as users simply connect with their wallets to the web-based platform. It spares them the need to spend a significant amount of resources on developing their own smart contracts and tokenization products. Tokenization platforms allow organizations to benefit from industry grade software at an affordable price and much instantaneous deliverability.

Asset tokenization in general improves liquidity particularly for illiquid non-fungible assets and private securities. As the fractionalization of ownership prevents smaller investors from being priced out, the investment base of an asset is expanded. Furthermore, digital assets can be traded 24/7 on the market.

Another benefit of asset tokenization is reduced costs. As intermediaries can be eliminated, there is a reduction of trading spreads and transaction costs are cheaper. Moreover, asset tokenization supports real time transactions which allow for quick and efficient peer-to-peer transactions.

As the rights and obligations of the token holder are specified in the smart contract that describes the token’s characteristics, transparency is guaranteed. The data that is recorded on a blockchain cannot be removed, modified or amended and is thus unchangeable.

Risks associated with asset tokenization platforms

The risks associated with asset tokenization platforms primarily refer to the risks of all tokenized securities. Market prices for tokenized assets may be highly variable and can significantly derive from the fair value of an asset. Other risks related to asset tokenization are regulatory changes, cyber-attacks and crypto heists.

Similar to private equity and debt investments, the credit and counterparty risk of investing in tokenized assets may be vital. Moreover, operational risks of asset tokenization are that once funds are sent to a specified blockchain address, the transaction is irreversible.

A risk specifically related to asset tokenization platforms is that they usually rely on open-source software for development purposes and thus users may encounter theft of tokenized assets or programming errors. However, these risks are reduced if the asset tokenization platform commits to a smart contract audit.

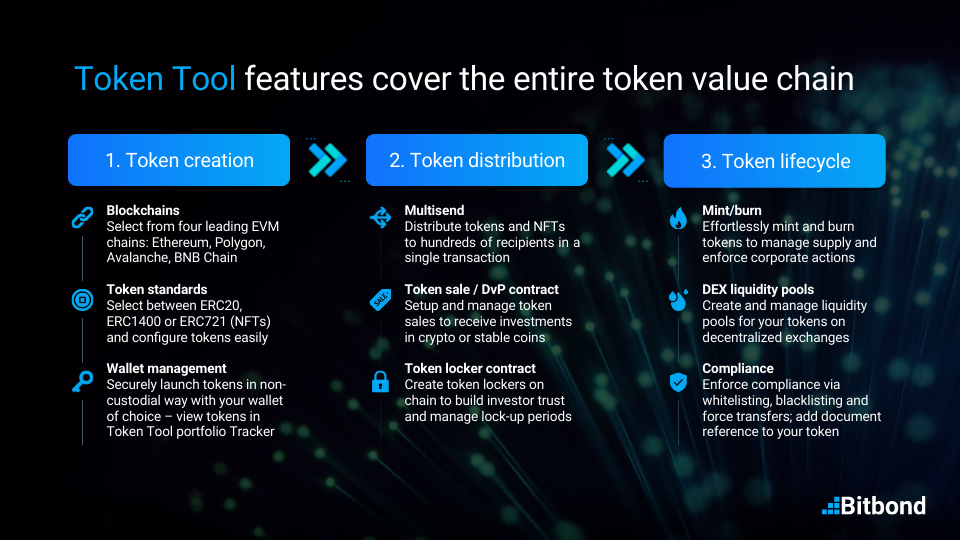

Tokenization platform features

Tokenization platforms such as Token Tool by Bitbond, offer a variety of services such as creating, managing, and distributing tokens. Additional features include launching token sales, tracking crypto portfolios and gas prices. Token Tool offers support for four EVM compatible chains including Ethereum, Polygon, Avalanche and Binance Smart Chain.

Portfolio Tracker

The Portfolio tracker function gives users an overview of the assets they own as well as the total value of their digital assets. As investors hold funds in multiple custody solutions, it provides a seamless overview over their crypto-assets across different platforms. The value is calculated by identifying the user’s token balance and multiplying it by the current price of the asset. To provide information on the type of tokens the user owns, the portfolio tracker differentiates between ERC-20/ERC-1400 tokens and NFTs. To make token lifecycle management more convenient, tokens can be managed directly from the tokenization platform.

Create Token

The Create token feature allows minting tokens directly through using the tokenization platform. It spares users the need to be proficient with smart contract programming as no coding is required. The tokenization platform handles the technical know-how providing users with a seamless process for benefiting from tokenization. Asset tokenization is made much more accessible through the use of tokenization platforms. Before the token is issued, users must define the token parameters like name, symbol, initial supply, and configure token features.

Manage Token

Tokens can be minted or burned using the Manage token function available in the tokenization platform. Moreover, this feature allows the creation of liquidity pools as well as changing the token’s owner and renouncing ownership. Using this functionality, users can also whitelist or blacklist wallet addresses after the token issuance. The manage token function of Token Tool works with all tokens, even those that were not created using Bitbond’s tokenization platform.

Distribute token

The Distribute token function allows users to send ERC-20 tokens to multiple recipients at once. In practice, the multisend feature is commonly used when an issuer is required to send a bundle of tokens or funds to multiple investors at the same time. It can also be used for interest payouts such as dividend and coupon payments to investors. The list of addresses can either be entered into the system manually or automatically via uploading a CSV file. Lists of token holders can be downloaded as CSV files from block explorers like Etherscan.

Create token sale

Security Token Offerings (STO), Initial Dex Offerings (IDO), or Initial Coin Offering (ICO) are token offerings that can be created using the Create token sale function. In a token presale, aka a crowdsale, a predefined amount of funds is distributed to investors and issuers. With Token Tool, it is possible to configure the token presale as well as define the token offering’s price, presale cap amount and lock duration.

Manage token sale

After a token sale is created, the Manage token sale function allows users to review the parameters of the token sale directly via the tokenization platform. The parameters of the token offering can be edited until the start of the sale. Thus, additional addresses can be added to whitelist investors if whitelist is required, and a shareable token sale URL is provided for accepting investments. The issuer can also embed the token sale investor page into their own website using the tokenization platform’s iFrame feature.

Create token locker

The Create token locker function allows users to disable tokens from being transferred for a specific period of time. For example, Liquidity Pool or founder tokens of projects can be locked for a certain period of time to show commitment to the project, and to further improve credibility,

Create NFT

The Create NFT function is very similar to the create token function, however, a different token standard is used. Compared to the create token feature, the create NFT function utilizes the ERC-721 token standard. Similarly, no programming skills are required as the smart contract is generated automatically by the tokenization platform.

Manage NFT

To review configurations and parameters of NFTs that were already created, the Manage NFT feature can be used. Additionally, this functionality allows users to attach metadata such as images to NFTs or NFT collections. It is also possible to add single files as metadata or to upload a CSV file. Furthermore, whitelist addresses can be modified. Similar to the manage token function, this feature works for all NFTs even if they were not created using Token Tool’s tokenization platform.

Distribute NFT

NFTs can be sent to multiple recipients at the same time using the Distribute NFT functionality. Here, Token Tool supports the transfer of ERC-721 as well as ERC-1155 tokens. Likewise, the token addresses can be entered manually or automatically via a CSV upload. This function also works with all tokens even if they were not created with Token Tool.

Create chain record

The Create chain record function enables on-chain registry entries and the creation of on-chain messages. Thus, this feature allows users to keep record of on-chain securities transactions. To add an on-chain message, either a normal text or a hash can be used.

Gas prices

The gas price refers to the costs charged by the blockchain network per transaction. As these differ between chains, Token Tool offers information on the gas price in USD and Gwei for Ethereum, Polygon, Avalanche and BNB Chain. For each network, prices are shown for slow, normal and fast transaction times.

Final Remarks

Blockchain technology and tokenization are gaining in popularity thanks to the significant benefits they bring to financial services. Developing blockchain-based products can prove to be highly challenging, especially for organizations that are not specialized in it and lack the technical knowledge to effectively develop such products.

Tokenization platforms cater to that specific pain as they significantly increase access to asset tokenization. Issuers looking to benefit from tokenization to fundraise their project, or manage assets, can now easily leverage the power of blockchain technology by using top notch asset tokenization products. As tokenization platforms such as Token Tool are Web3 based products, no lengthy onboarding or cumbersome integrations are required. Simply connect to the tokenization platform with your wallet and complete the tasks required.

The smart contract security and convenience that tokenization platforms offer is another major step towards the mainstream adoption of blockchain technology.