Table of Contents

Healthy Tokenomics is an Absolute Necessity!

In the rapidly evolving world of blockchain and cryptocurrencies, having a solid tokenomics model is no longer just an advantage; it’s an absolute necessity.

Startups and emerging businesses that fail to design a robust tokenomics model risk losing the interest of investors, suffering from poor user adoption, and ultimately, facing the collapse of their projects. The consequences of overlooking this crucial aspect of blockchain projects can be dire, leading to wasted resources, damaged reputations, and even complete business failure.

But how can you, as a startup or an emerging business, navigate the complexities of tokenomics and ensure the successful implementation of a token economy that fuels growth, incentivizes user behavior, and remains sustainable in the long run?

The answer lies in understanding the key principles, best practices, and challenges of tokenomics, as well as learning from the successes and failures of other projects in the space.

At Bitbond, we’ve seen our fair share of token designs being implemented by startups using TokenTool.

In this comprehensive guide, we’ll dive deep into the world of tokenomics, equipping you with the knowledge and tools necessary to design and implement a thriving token economy for your blockchain project.

By the end of this guide, you will be able to avoid the pitfalls and maximize the potential of your project by mastering the art and science of tokenomics.

Definition of Tokenomics

Tokenomics, also known as token economics, refers to the study and design of economic systems within blockchain-based projects, focusing on the creation, distribution, and management of digital tokens. Tokenomics plays a critical role in determining the success and sustainability of a project by driving user adoption, incentivizing desired behaviors, and ensuring a project’s long-term viability.

Importance of Tokenomics

Tokenomics is a vital aspect of any blockchain project as it serves as the foundation of a project’s economic structure. Whether you decide to go with an ICO or an IDO to launch your token, a well-designed tokenomics model can:

- Encourage user adoption and retention

- Create and maintain a healthy, self-sustaining ecosystem

- Attract investors and funding

- Provide a means for value exchange and incentivization within the platform

Example: Bitcoin’s Tokenomics

Bitcoin is the world’s first and most well-known cryptocurrency, with a tokenomics model centered around a fixed supply and a deflationary emission schedule. There are only 21 million bitcoins that will ever be created. As more bitcoins are mined, the rate at which new coins are released decreases, creating scarcity, and driving up the value of the existing supply. This model has been successful in attracting investors and encouraging long-term holding, resulting in a steadily increasing price over time.

Features of Tokenomics

There are several key features to consider when designing tokenomics for a project, each with its implications and trade-offs.

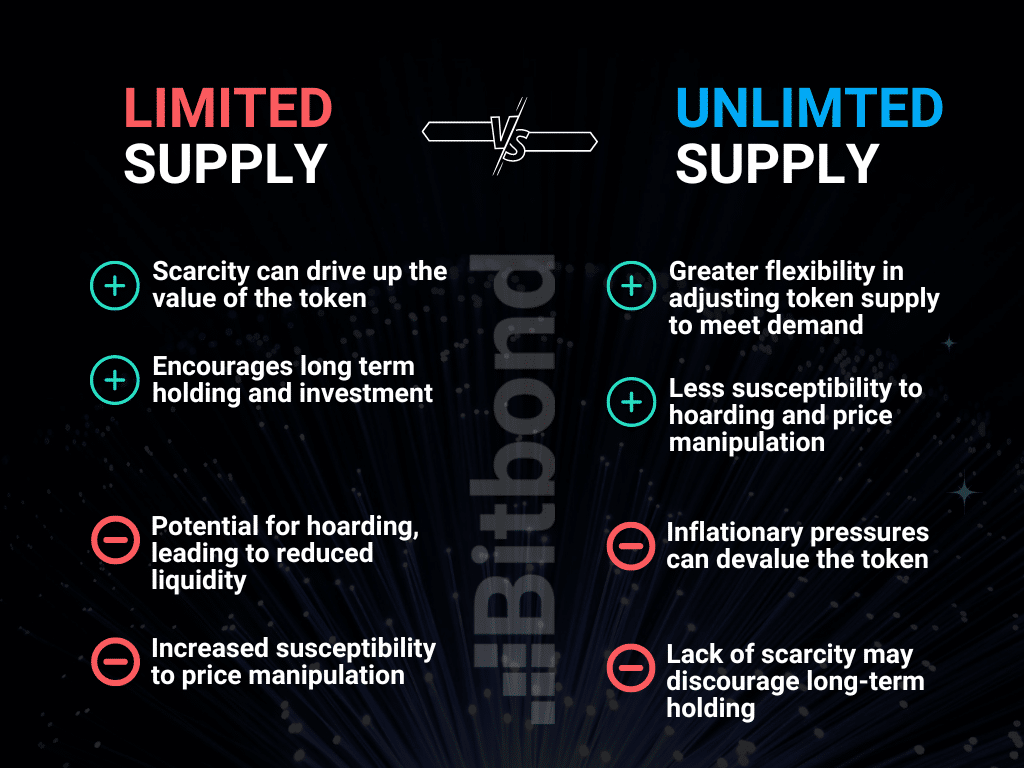

Limited Supply Vs. Unlimited Supply

Tokens can be designed with a limited or unlimited supply. Limited supply tokens have a fixed cap on the total number of tokens that will ever be created, while unlimited supply tokens do not have a predetermined cap.

Consensus Mechanism

A consensus mechanism is a process by which a blockchain network agrees on the validity of transactions and adds new blocks to the chain. Common consensus mechanisms include Proof of Work (used by Bitcoin), Proof of Stake (used by Ethereum), and Delegated Proof of Stake.

Each mechanism has its strengths and weaknesses in terms of energy efficiency, security, and decentralization. Consensus mechanisms are features of layer 1 blockchains, so if you wish to create an Ethereum-based token, then you won’t need a consensus mechanism for it.

Token Utility

Token utility refers to the various functions and purposes that a token serves within its ecosystem.

Examples of token utility include

- Medium of exchange for goods and services

- Access to platform features or exclusive content

- Governance and voting rights within the project

- Staking and earning rewards

Token Burns

involve the intentional removal of tokens from circulation, typically by sending them to an inaccessible address or “burn” address. Token burns can be used to:

- Reduce the overall token supply, increasing scarcity and potentially driving up the value

- Combat inflationary pressures

- Provide a deflationary mechanism for platforms with unlimited token supplies

- Reward long-term holders and investors by decreasing the circulating supply

Token Distribution, Lock-up & Vesting

Token distribution is the process by which tokens are allocated to various stakeholders, including team members, investors, and users. It’s essential to have a fair and transparent distribution to encourage trust and confidence in the project. Lock-up periods and vesting schedules can help align incentives, ensuring that stakeholders remain committed to the project’s long-term success.

Lock-up periods are predetermined time frames during which tokens are inaccessible or non-transferable, often used for team tokens or early investor tokens.

Vesting schedules, on the other hand, gradually release tokens to their recipients over time, helping to prevent sudden sell-offs and maintain token price stability.

Game Theory

Game theory, a fundamental mechanism underlying many technologies, is the systematic study of decision-making processes and the reasoning behind them. By utilizing mathematical models of conflict and cooperation, game theory seeks to comprehend the behavior of decision-makers in various situations.

In the context of cryptocurrencies, game theory enables developers to evaluate the decision-making processes of stakeholders within an interactive environment.

Strategic elements in tokenomics design can bolster the demand for a token. Lock-up mechanisms, for example, have proven to be an effective application of game theory in tokenomics.

Such mechanisms incentivize token holders to lock their tokens in a contract, rewarding them with increased returns. The Curve protocol demonstrates this concept, as users lock their CRV tokens to receive a share of the revenue.

The longer the tokens are locked, the higher the earnings. This creates a strong incentive for stakers to keep their tokens locked, contributing to the stability and long-term success of the project.

Good Signs Vs. Bad Signs

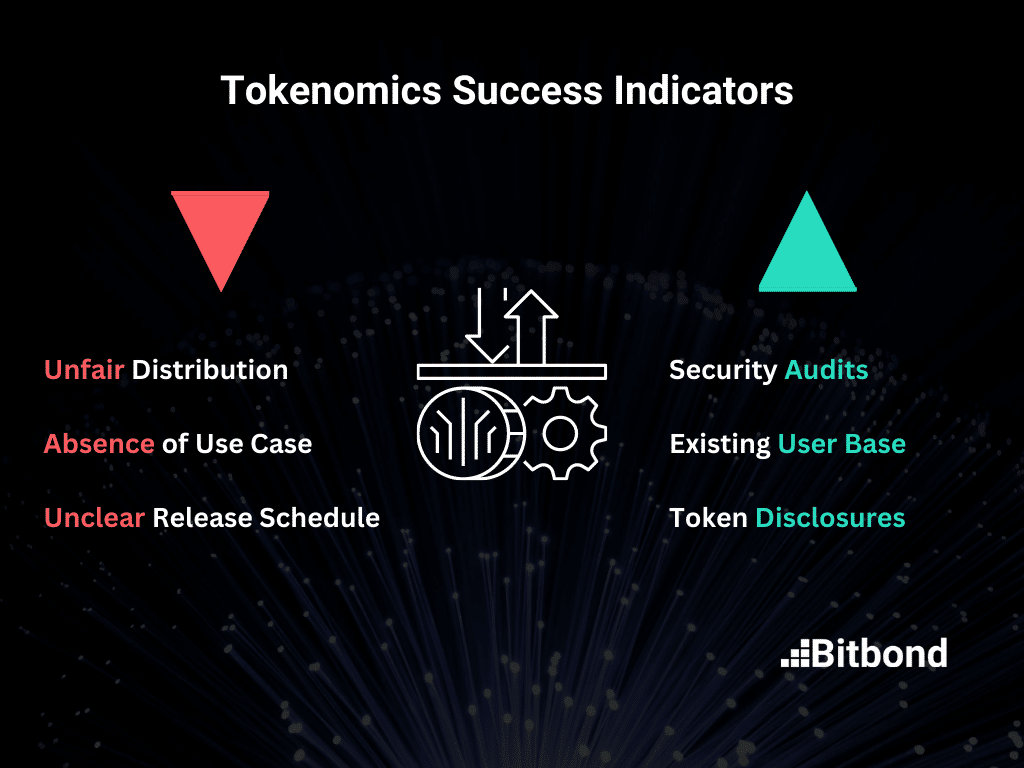

When evaluating a project’s tokenomics, it’s essential to look for both positive and negative indicators of the project’s potential success.

Good Signs

- Security Audits: Regular security audits by reputable firms indicate a commitment to maintaining a secure and reliable platform.

- Existing User Base: A strong and growing user base demonstrates user interest and adoption, a critical factor to have before launching a token and setting it up for long-term success.

- Token Disclosures: Transparent information about token distribution, lock-up periods, and vesting schedules fosters trust and credibility.

Bad Signs

- Unfair Distribution: A heavily skewed token distribution favoring the team or a small group of investors can indicate a lack of commitment to fairness and decentralization.

- No Real Use Case: Tokens without a clear use case or utility within their ecosystem may struggle to attract users and maintain value.

- Opaque / Unclear Release Schedule: A lack of transparency about token release schedules and distribution can indicate potential manipulation or hidden agendas.

UniSwap and Compound’s Tokenomics: A Brief Comparison

Both UniSwap and Compound are popular DeFi platforms, but they have distinct tokenomics models.

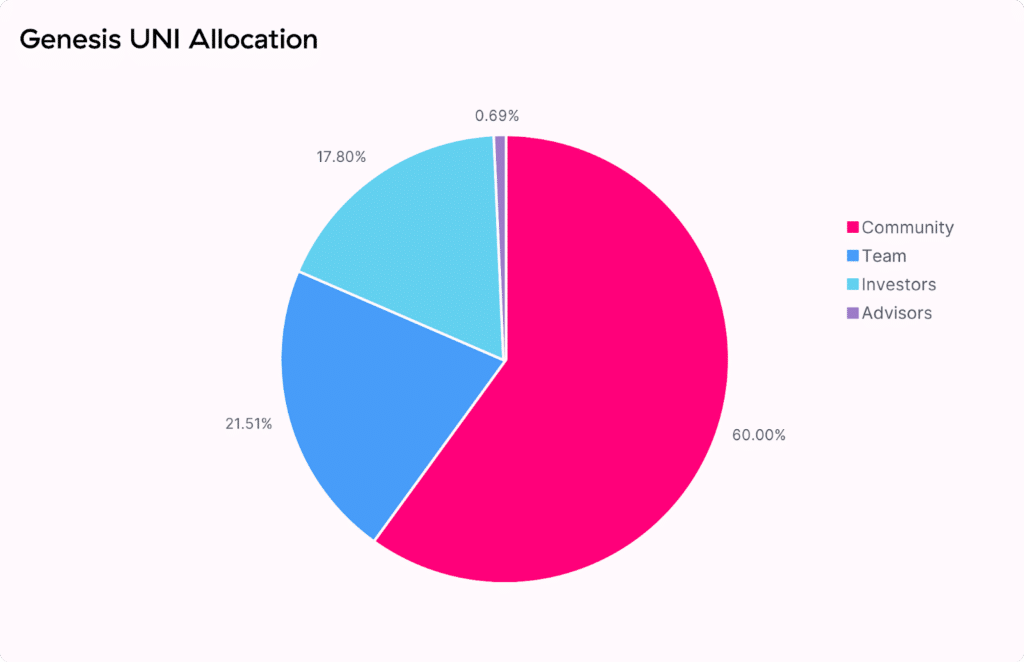

UniSwap’s native token, UNI, primarily serves as a governance token, allowing holders to participate in the platform’s decision-making process. Token distribution was heavily focused on rewarding early users and liquidity providers, with 60% of the total supply allocated to the community. UNI has no inflationary or deflationary mechanisms, relying on its governance and utility to drive value.

Compound, on the other hand, has a dual-token system with the governance token COMP and cTokens, which represent a user’s share in a specific lending market. The platform has a more complex tokenomics model, with distribution primarily focused on incentivizing borrowing and lending on the platform. Compound also employs a token-burning mechanism, adding a deflationary aspect to its token economics.

Future of Tokenomics

Tokenomics will continue to play a vital role in the success and sustainability of blockchain projects. As the industry evolves, projects must continually refine and optimize their tokenomics models to stay competitive and provide value to users, investors, and other stakeholders.

Token design and human psychology are inheritably related. A meaningfully designed token economy considers the motives and needs of individuals willing to participate in that ecosystem and aims to predict user behaviors that result from features within the ecosystem.

Startups and emerging businesses entering the blockchain space must thoroughly understand the key principles, best practices, and challenges associated with tokenomics to maximize their chances of success. Hence why it is recommended to consult with an expert to make sure that you are setting your token model right for success.