Table of Contents

Multiple fundraising methods have attracted investors to the world of crypto. After the rise of coin offerings (ICOs), security token offerings (STOs), and initial exchange offerings (IEOs), IDOs offered a fairer approach to launching a project as it prioritizes the project’s community over its founders and early investors.

What is an Initial DEX Offering?

Evolution of Token Offerings

Ever since IDOs started gaining popularity, the industry has witnessed tremendous growth across the board. Some IDOs performed as much as 100x growth since launch, while the most successful hit more than 200X growth.

As the tokenization industry evolves, businesses are consistently seeking novel ways to leverage blockchain technology.

So, what is exactly meant by an IDO?

Definition of an IDO

Initial DEX Offering (IDO) is a novel decentralized fundraising method that’s paving a new path for startups to raise funds and for investors to access innovative projects.

An Initial DEX Offering (IDO) enables projects to launch their tokens directly on decentralized exchanges (DEXs), bypassing traditional initial coin offering (ICO) or initial exchange offering (IEO) processes.

How Do IDOs Work?

Launching a Token on a Decentralized Exchange

Businesses or projects launch their token using a decentralized liquidity exchange.

The project offers its token to the DEX at a fixed price. Then, users can commit their funds through the platform.

Automated Market Makers, Liquidity Pools, and Bonding Curves

Smart contracts, which act as the Automated Market Maker (AMM), gather investor funds. These contracts allow traders to swap assets directly from the liquidity pool. Users can trade their tokens after receiving their tokens during the Token Generation Event (TGE).

Bonding curves represent an advanced pricing system that establishes the exact exchange rate. The price fluctuates depending on the proportion of assets within the pool, rising when coins are bought and falling when investors sell. Traders are responsible for upholding the pricing framework. By “locking” their assets in the pool, traders generate liquidity and are rewarded for their contribution.

By relying on liquidity pools, traders can swap and exchange tokens, coins, and stablecoins. An example of a liquidity pair would be USDC/ETH.

IDOs, ICOs, and IEOs: What’s the Difference?

Initial Coin Offerings

An initial Coin Offering (ICOs) is a fund-raising method for a cryptocurrency held on a project’s website. Projects publish a technical whitepaper explaining what their business is about and how they plan to use the funds, like a traditional IPO, then investors can participate in the sale.

Initial Exchange Offerings

Initial Exchange Offerings (IEOs) are like ICOs but are conducted on a centralized exchange. Listing on a reputable exchange can increase investor trust in the said project, but this comes at a cost. Exchanges often charge high listing fees and take a portion of the token sale.

Benefits of an IDO compared to ICOs and IEOs

An initial DEX offering boasts numerous distinct benefits when contrasted with initial exchange offerings (IEO) and initial coin offerings (ICO).

Cost Savings, Permissionless Listing, and Instant Liquidity

In the case of IEOs or ICOs, projects must initially pay exchange fees and await approval from the exchange before getting listed. However, IDOs eliminate the need for paying hefty fees and seeking permission, as they are fully decentralized offerings.

Rather than relying on an exchange to approve a project, it’s the vocal community members who evaluate projects and tokens. This approach creates opportunities for smaller projects and extensive collaborations.

Unlike IEOs and ICOs, which entail an initial waiting period, IDOs offer instant access to liquidity and trading.

The table below compares the benefits of IDOs over ICOs and IEOs across different categories.

The Amounts Raised through IDOs by Category

Leading Sectors in IDO Fundraising

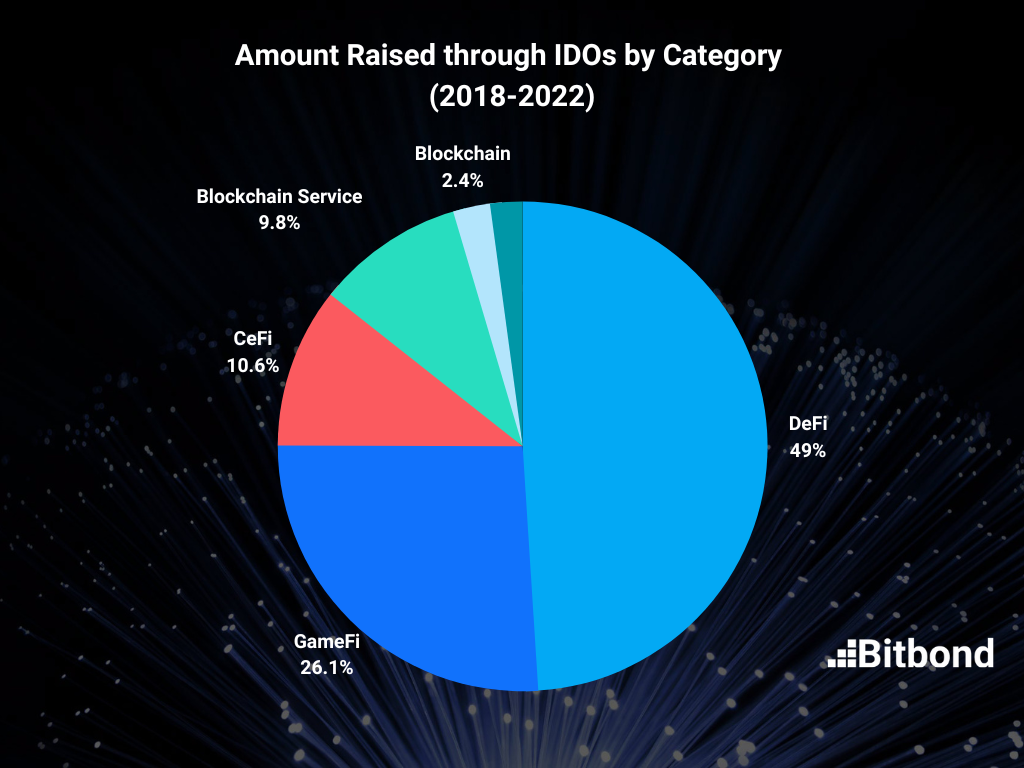

Projects tackling different use cases across DeFi, CeFi, GameFi, Blockchain Services, and Blockchain have resorted to IDOs as their go-to method to raise funds. The leading category is DeFi, amounting to almost half of the total $1.6 billion raised using IDOs since 2018. The total number is expected to continue an upward trend in the coming years as more people resort to DeFi for alternative financing.

To launch your IDO and maximize its benefits, you can further simplify your journey by using a tokenization platform like Token Tool by Bitbond. Creating, managing, distributing tokens, launching token sales, and tracking crypto portfolios, as well as gas prices, are some of the features that Token Tool offers to simplify asset tokenization for businesses of all sizes.

Amount Raised on IDO Platforms by Sector (2018-2022):

Advantages of IDO for Projects and Investors

For Projects

- Reduced costs

- Expedited fundraising

- Immediate liquidity

- Increased transparency

For Investors

- Directly access new projects via DEXs

- Enjoy lower fees

- Take advantage of decentralized and non-custodial trading, reducing risks associated with a centralized exchange

After the collapse of the renowned crypto exchange FTX last year, investors pivoted away from centralized exchanges and resorted to DEXs instead. Volumes on DEXs like UnisSwap more than tripled as the DeFi Weekly Exchange volumes hit $32 billion.

This further solidifies the importance of transparency and non-custodial trading for both projects and investors respectively.

Challenges and Risks of IDOs

Although IDOs offer multiple benefits, they also come with challenges and risks, including potential regulatory issues, market manipulation, and scams.

To counter these risks and ensure a successful IDO, projects must adhere to best practices such as KYC regulations that are made easier through tokenization platforms like Bitbond Token Tool.

IDO Best Practices

Launching a successful IDO is by no means a task to take lightly, so here are some best practices to guide you along the way.

- Strong Project Foundation

Develop a compelling and unique value proposition that addresses a real-world problem or presents an innovative solution. Ensure that your project’s vision, goals, and objectives are clear and well-defined.

This also includes ensuring regulatory compliance as it is a critical aspect of any successful IDO. Token Tool’s built-in professional services support enables users to easily comply with regulations. This ensures that your project adheres to relevant regulations, mitigating risks, and building trust among investors. - Robust Tokenomics

Design a transparent and well-structured tokenomics model that outlines token distribution, allocation, total supply, lock-up periods, and vesting schedules.

Creating, issuing, and managing tokens is a complex process, but TokenTool streamlines it by providing an intuitive interface for managing the entire token life cycle. This end-to-end management allows your project to focus on its core objectives, knowing that the technical aspects of launching an IDO are in expert hands.

With a few clicks on TokenTool, you can easily issue tokens to investors during your IDO, ensuring a seamless and efficient fundraising process. Using the portfolio tracker, you get an overview of balances, manage holders, and perform necessary actions such as burning or minting tokens. - Comprehensive Whitepaper

Create a detailed and well-organized whitepaper that provides in-depth information about your project’s features, technology, team background, and roadmap. A thorough whitepaper showcases your project’s credibility and instills confidence in potential investors. This helps build trust and reduces the risk of speculation. - Experienced Team and Advisors

Assemble a skilled and reputable team with a proven track record in the industry. Include information about the team’s expertise and experience in the whitepaper and on the project website. Having advisors with relevant industry experience can enhance your project’s credibility.

If you’re not sure where to start, reach out to our team and we’ll assist you on your IDO journey! - Robust Marketing Strategy

Utilize multiple channels, such as social media, community engagement, and press releases, to create awareness and excitement about your project. Harness the power of Web3 Affiliate Programs, engage with influencers, and leverage search engine optimization (SEO) to reach a wider audience.

Forge partnerships with established industry players to boost your project’s credibility and increase adoption. Collaborating with other platforms and projects in the ecosystem demonstrates your project’s ability to work within the crypto community. - Security

Security is crucial when handling digital assets, and to build trust among potential investors and reduce the risk of hacks or exploits, it’s important to conduct third-party audits of your project’s smart contracts to identify and fix vulnerabilities.

Token Tool’s cutting-edge custody technology ensures that you launch industry-grade audited smart contracts to safely keep your tokens. TokenTool uses advanced encryption techniques and multi-signature wallets to protect your assets from theft and unauthorized access.

TokenTool also helps you stay compliant by creating whitelist addresses for your verified investors, thus making it easier to streamline Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. - Choose your IDO Launchpad

Select a reputable and reliable IDO Launchpad with a track record of successful projects. The right launchpad can help with marketing, community building, and technical support, increasing the chances of a successful IDO. Token Tool is a great alternative to a launchpad to kick-start your first IDO. As your all-in-one tokenization solution for financing your project, Token Tool enables users to create smart contracts in a few minutes without any coding required.

TokenTool supports multiple blockchain networks, including Ethereum, Binance Smart Chain, and other EVM chains, allowing you to choose the most suitable network for your project.

Conclusion

As the popularity of Initial DEX Offerings continues to grow, businesses must be equipped with the right tools and knowledge to explore this new fundraising landscape.

We know that launching your first IDO can be a lot to deal with. Alongside your core business, launching a successful IDO is a daunting process.

With years of experience in the tokenization space, we’ve seen first-hand the ups and downs of IDOs, what works, and what doesn’t.

Other than the technical implementation of smart contracts, navigating the complex world of regulations is a lot to keep up with, but not when done with the right partners!

Bitbond’s professional services team can advise you on the technical implementation for your project to maintain compliance with legal and regulatory requirements, reducing the risk of potential setbacks.

Using Token Tool, we simplify the process of asset tokenization and provide an all-in-one solution for businesses looking to launch a successful IDO.

With our Enterprise Solution, our team offers advice on tokenization strategies to assist you throughout every step and ensure the success of your project’s IDO.