Table of Contents

In the realm of blockchain technology, ERC-20 tokens have emerged as a ubiquitous standard for creating fungible tokens on the Ethereum network. These tokens, named after the 20th Ethereum Improvement Proposal (EIP), are characterized by their interchangeable nature, allowing for seamless transfer and trade between wallets. While ERC-20 has revolutionized the blockchain ecosystem, its compliance with financial regulations remains a subject of debate for financial institutions.

What is an ERC20 Token?

An ERC-20 token is the token standard used for creating fungible tokens on the Ethereum blockchain. They basically allow the creation of tokens with identical properties, in type and value, allowing them to be easily transacted and transferable between wallets.

ERC-20 tokens are the most popular, and widely adopted Ethereum-based tokens. In their essence, tokens issued on blockchain are basically smart contracts that make use of the blockchain they were issued on. Ethereum network gained traction due to the smart contract function it possesses. This function enables the creation of smart contracts that automatically execute a set of predefined rules programmed in the code of that contract.

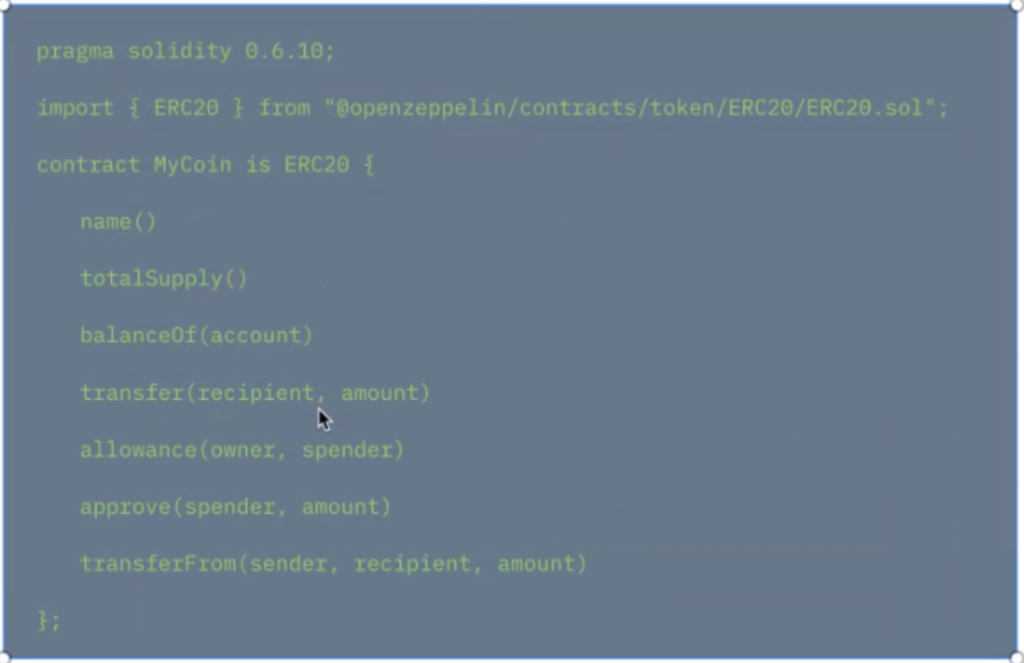

The ERC-20 standard dictates a set of predefined rules that govern the behavior and interactions of fungible tokens. These rules encompass functionalities such as total supply management, token balance tracking, transfer authorization, and token approval. By adhering to these rules, ERC-20 tokens ensure uniformity and compatibility across different Ethereum-based applications and wallets.

What is the easier way to create an ERC-20 token?

To create an ERC-20 token, one must usually program the smart contract representing these tokens. However, using Token Tool by Bitbond, users can easily create erc-20 tokens without any coding. Simply fill in the blank by choosing your token parameters, click on create token, and benefit from Bitbond’s renowned track record in developing institutional-grade tokenization solution.

The video below goes through the process of creating an ERC-20 token using Token Tool:

The Appeal and Limitations of ERC-20 Tokens

The ease of creation, flexibility, and widespread adoption are among the key factors driving the popularity of ERC-20 tokens. These tokens have found widespread applications in decentralized finance (DeFi) projects, serving as utility tokens, stablecoins, and security tokens. However, ERC-20 tokens also present certain limitations that financial institutions need to consider.

The ERC-20 token standard is one among many other token standards available in the Ethereum network. ERC-20 token standard consists of the following predefined rules, these rules apply to all fungible Ethereum tokens:

- Total supply

- Balance of

- Allowance

- Transfer

- Approve

- Transfer from

This set of functions ensures that all types of tokens created on the Ethereum blockchain conform to the standard and perform uniformly across any Ethereum system. Therefore, most digital wallets supporting ETH are also compatible with ERC-20 Token adhering to that standard.

Below an example of the most basic code version of an ERC-20 Token:

Here are some of the most popular token standards on Ethereum:

- ERC-20 – A standard interface for fungible (interchangeable) tokens, like voting tokens, staking tokens or virtual currencies.

- ERC-721 – A standard interface for non-fungible tokens, like a deed for artwork or a song.

- ERC-777 – It allows people to build extra functionality on top of tokens such as a mixer contract for improved transaction privacy or an emergency recovery function to bail you out if you lose your private keys.

- ERC-1155 – It allows for more efficient trades and bundling of transactions – thus saving costs. This token standard allows for creating both utility tokens (such as $BNB or $BAT) and Non-Fungible Tokens like CryptoPunks.

Depending on the asset being issued and the functionality you want its token representation to inherit, different standards are used to create the tokens accordingly. For instance, for NFTs, which are considered to be non-fungible, meaning each token is unique to its representation and is non-interchangeable, the ERC-721 standard is used. This applies mainly due to the fact that it should possess a unique identifier to it or signature, making it stand out from other NFT tokens just like it. This is not the case for ERC-20 tokens which are alike.

Addressing the Regulatory Gap: ERC-1400

Other than the ERC-20 token standard, security tokens that are a representation of traditional financial securities (e.g bonds, stocks, equity), require more compliance standards, and therefore, a more broad set of features & functionalities. An example of such features in traditional finance would be corporate actions that issuers need to take upon issuing certain securities.

As the ERC-20 token is limited and doesn’t offer such capabilities, the ERC-1400tToken standard was introduced to serve that specific purpose. It can be considered as the compliance token.

ERC-1400 – is a standard specifically designed for Security Tokens. It allows more control over the token and it inherited its functions from the ERC-20 token. It does allow for example restricted transfers, the adding of transfer information, document library management and forced transfers. It does so by combining various ERC standards, which each fulfill another aspect of (potentially) needed Security Token functionality. It therefore has a wide range of functionality that enable a legal conform deployment of Security Token. This approach is comprehensive, but also complex.

In short, the ERC-1400 standard allows:

- Transfer controls (if a user wants to send a transaction, they require a valid hash from an issuer – aka certificate)

- Controllers can force token transfers, token creation, or destruction

- Partitions – labels for individual tokens, marking them for different use-cases / asset classes

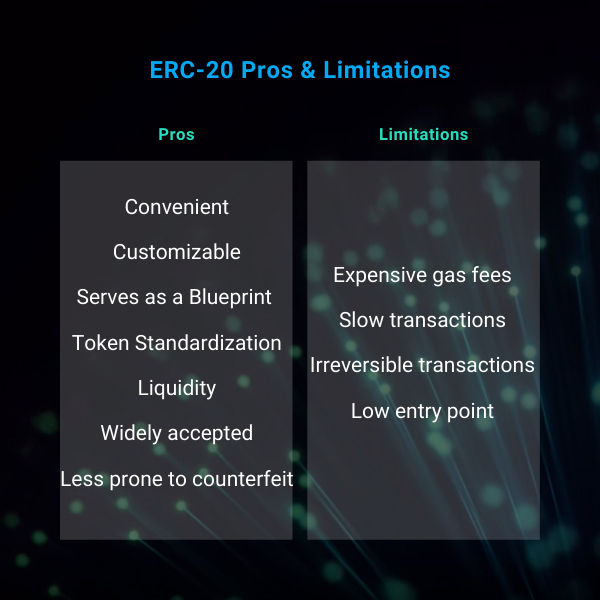

The Pros of ERC-20 Tokens

ERC-20 are popular for a reason, and here’s are several factors that make them attractive:

Convenient: ERC-20 tokens are simple and easy to deploy. That’s because Ethereum smart contracts are written in a Solidity programming language similar to JavaScript. Any other protocol that is EVM-Compatible, can support ERC-20 tokens.

Flexible for customization: Depending on the business logic and user interactions, ERC-20 tokens are customizable to enable features like gas auto-refill for future transactions, freezing and unfreezing a token, adding on a central mint to modify the tokens in circulation, and more.

Serves as a roadmap for developers: The ERC-20 standard gives developers a proper blueprint, which allows them to create new tokens in an effortless way instead of building them from scratch.

Token standardization: Ethereum provides the token specification that includes interaction rules between different tokens and token purchase rules. With a universal standard, users can transfer new tokens to a wallet and be put on an exchange all at once.

Liquidity: If the projects based on Ethereum are active and interact with each other, that brings more projects and more users to the Ethereum network. There is also a solution like Uniswap converting ERC-20 tokens between each other has become even more straightforward.

Widely Accepted: ERC-20, as well as its tokens, are recognizable on most exchanges and wallets. That is mainly because of the universal protocol that is adaptable by broad exchanges. Plus, its fungibility makes it excellent for trading applications.

Eradicate counterfeit tokens: All transactions are subject to approval, and the total supply of tokens smoothens the auditing process by ensuring there’s no duplicate of tokens in circulation.

Although it’s the most widely adopted standard, as mentioned in the previous section, ERC-20 still has a few limitations

The Limitations of ERC-20 Tokens

Expensive gas fee: ERC-20 relies on the Ethereum blockchain, and to complete each transaction, there will be a gas fee. While the gas fee is parallel to the blockchain activities, the gas fees increase when there’s heavy traffic in the blockchain. Hence, it’s not sustainable in the long-run.

Slow transactions: The withdrawal and transactions are correlated to the Ethereum blockchain. When the network is congested, all of the transfers on ERC-20 will be slowed. Though ‘Sharding’ is expected to resolve this problem, it’s still at its infant phase and yet to be fully-adopted on Ethereum blockchain.

Irreversible transactions: There is no way to return funds if users send ERC-20 tokens to the wrong address, and tokens remain forever trapped in contracts. The same applies to the tokens stolen by hackers.

A very low entry point: Critics say that it is too easy for people to create their tokens with no apparent purpose or goals. As a result, developers can easily exploit the policies to develop fraudulent ICOs and tokens with non-value adding projects.

Emerging Trends and Adaptability

As the blockchain industry continues to evolve, new token standards are emerging to address specific needs and challenges. For instance, the ERC-777 standard introduces features like mixer contracts for enhanced transaction privacy and emergency recovery functions. Similarly, the ERC-1155 standard facilitates more efficient trades and bundling of transactions, streamlining the token economy.

Financial Institutions Embracing the Blockchain Revolution

Financial institutions are increasingly embracing blockchain technology, recognizing its potential to enhance efficiency, transparency, and cost savings. While ERC-1400 has emerged as a frontrunner for security token issuance, other token standards are also gaining traction. Financial institutions need to carefully evaluate the suitability of different standards based on their specific use cases and regulatory requirements.

Is the ERC20 Token Compliant for Financial Insitituions?

The ERC-20 token standard has revolutionized the blockchain ecosystem, enabling a wide range of applications. However, financial institutions seeking to utilize ERC-20 tokens must carefully consider their compliance implications. ERC-1400 addresses the regulatory gap for security tokens, while other emerging standards offer additional functionalities. By adopting a proactive approach to regulatory compliance and exploring innovative token standards, financial institutions can harness the power of blockchain technology while navigating the evolving regulatory landscape.

In summary, ERC20 tokens are not inherently compliant with financial regulations, and financial institutions should carefully consider the regulatory implications of using them.

Make sure to get in touch to learn more about implementing blockchain within your organization or learn more about the topic in our resources.

Do you want to create a token in just a few minutes? Token Tool allows you to create ERC-20 tokens and tokens based on more sophisticated standards (i.e. ERC-1400) in just a few clicks: