Table of Contents

Non-fungible tokens (NFTs) have captivated the world in recent years, transforming digital collectibles and assets into unique, verifiable, and ownable pieces of information. This revolutionary technology has the potential to disrupt numerous industries, from art and gaming to finance and beyond. Learn about the basics of NFT Tokens in this ultimate guide.

What are NFTs?

A Brief History of NFTs: From Inception to Mainstream Adoption

The concept of NFTs emerged in 2014, but it wasn’t until 2017 that they gained traction with the introduction of the ERC-721 token standard on the Ethereum blockchain. This standard enabled the creation of distinct and non-interchangeable digital assets, paving the way for the explosion of NFT popularity in 2021.

NFTs became popular when CryptoKitties was launched, allowing users to collect, breed, and sell NFT kittens. The blockchain-based game was so successful that the transaction volume of CryptoKitties exceeded Ethereum’s maximum number of transactions per second resulting in network congestions.

2021 is often referred to as the “year of the NFT” due to the increase in NFT trading volume from 33 million to 13 billion between 2020 and 2021. Mainstream attention reached its first all-time-high when Beeple sold his digital artwork “Everydays: The first 5000 days” for $69 million in March 2021. Recent developments with the Bored Ape Yacht Club and Twitter integrating NFT profile pictures show that NFTs might be more than just a temporary trend.

NFT Token Minting: The Process of Creating Unique Digital Assets

Minting an NFT is the process of creating a unique digital asset that is linked to a specific blockchain. This process involves writing a smart contract that defines the ownership and attributes of the NFT, which is then stored on the blockchain. The NFT’s tokenID, a unique identifier, serves as the key to accessing its metadata and ownership information.

NFT Token Standards: A Guide to ERC-721, ERC-1155, and Flow

Different NFT token standards exist to cater to specific use cases and optimize transaction efficiency. The most widely used NFT standard is ERC-721, which enables the creation of unique and non-interchangeable tokens. ERC-1155 is another popular standard that allows for the creation of multiple types of tokens, including fungible and non-fungible, within a single smart contract. Flow, a blockchain specifically designed for NFTs and gaming, has gained traction due to its scalability and efficiency.

The 3 major NFT token standards

NFT token standards are evolving as rapidly as NFTs gain in popularity. As of today, the most common NFT token standards are on Ethereum. However, protocols like Polygon, Avalanche, Arbitrum, and more are catching up by addressing the scalability issues of the Ethereum blockchain.

ERC-721

The ERC-721 token standard is the most popular and widely used NFT standard. ERC-721 tokens run on the Ethereum blockchain and are open source. Compared to ERC-20 tokens, each ERC-721 token minted is unique and can be priced independently from other tokens.

As each ERC-721 token requires its own unique identifier, separate smart contracts must be minted for every NFT token or collection. This places redundant bytecodes on the Ethereum blockchain and limits the functionality of ERC-721 tokens.

Decentralized applications can be used to convert the encoded identifier into the file that the NFT represents. The tokenID thus functions as the input that is used to generate the multimedia file of the NFT.

ERC-1155

Similar to the ERC-721 token standard, the ERC-1155 token standard is open source and runs on the Ethereum blockchain. However, the ERC-1155 is a multi-asset token standard that allows users to register fungible and non-fungible tokens in the same smart contract. One TokenID can represent several configurable token types with their own attributes and metadata.

Additionally, the ERC-1155 token standard allows new functionalities like transferring multiple tokens. As there is no need to separately approve individual token contracts, trading volume is reduced leading to a reduction in transaction costs.

The ERC-1155 token standard is widely used in the gaming industry as it addresses multiple operational problems of blockchain games. For example, users can now buy in-game coins (fungible) and in-game items (non-fungible) by owning just one ERC-1155 token instead of multiple ERC-20 and ERC-721 tokens.

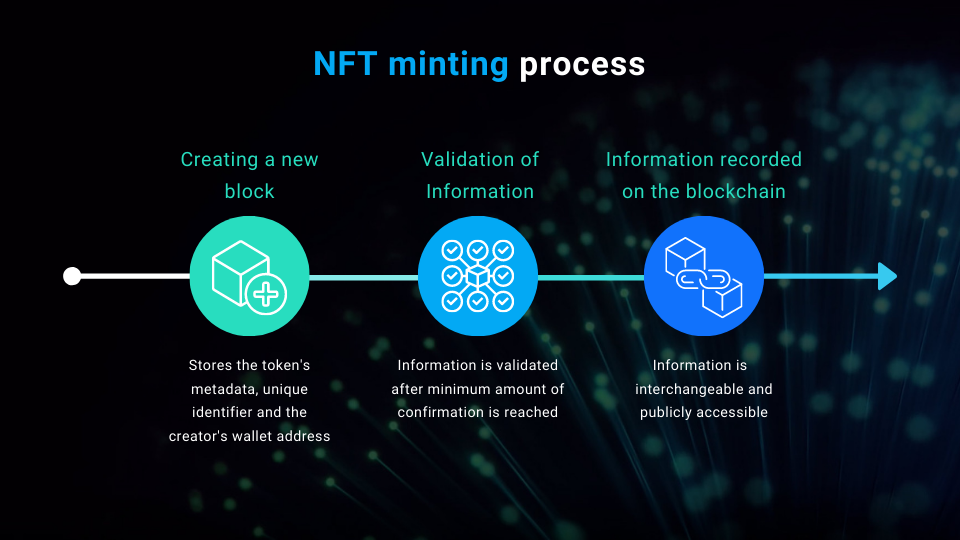

3 step NFT minting process:

- Minting a new block

- Validation of Information

- Information recorded on the blockchain

The minting process of an NFT is initiated by the creator of the smart contract. First, a new block is minted by storing the NFT’s metadata and TokenID, as well as the creator’s wallet address. Secondly, the block containing that information can be recorded on the blockchain only after the minimum amount of validation from nodes is achieved. Finally, the information is recorded on the blockchain.

Once the transaction is validated, the information is interchangeable and publicly accessible. For example, it is possible to trace specific tokens issued on the Ethereum blockchain via Etherscan. This guarantees transparency and verifiability.

How is ownership guaranteed?

Each token minted receives a unique identifier that is linked to the public wallet address of the creator. Hence, the creator’s public key is a permanent part of the token’s history. It serves as a certificate of authenticity for that specific digital asset.

All transactions made on a blockchain are irreversibly stored and are publicly accessible . It is therefore possible to identify all transactions related to a specific token. Wallet addresses of past owners and the public key of the current owner can be viewed by searching for the token’s unique identifier in the block explorer of the respective blockchain. Besides verifying authenticity, ownership can be proved for precisely every non-fungible token.

Metadata specifies the characteristics of an NFT

Each NFT corresponds to a specific set of metadata describing the characteristics of that NFT. The metadata specifies the multimedia content that the NFT represents and certifies. In order to attach metadata to the token’s ID, a hash is generated and saved in the smart contract.

Hashings are used to access the token’s metadata in a storage space-efficient way. The hash is associated with the respective token in the form of an url link. Therefore, NFT smart contracts do not store the multimedia files themselves but only the links to the respective off-chain resources.

The metadata must have precise fields in order to be shown correctly on marketplaces such as OpenSea or SuperRare. The minimum data necessary to define an NFT is name, description and image. Additionally, references to external sites can be used to link more attributes to the token.

NFT Applications: Revolutionizing Industries with Unique Assets

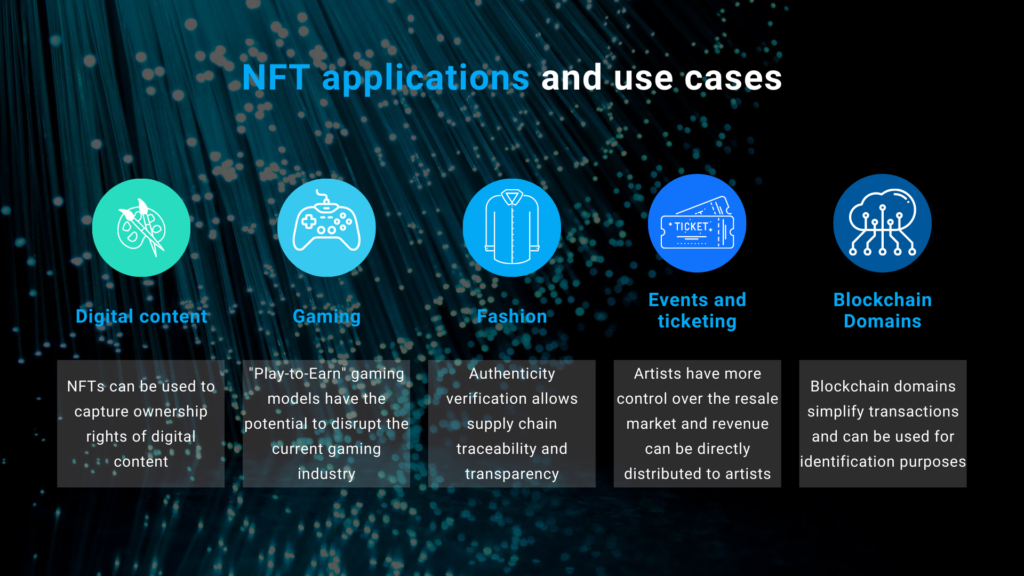

NFTs have the potential to revolutionize various industries by bringing unprecedented levels of transparency, ownership, and efficiency. Here are five compelling use cases for NFTs:

- Digital Art and Collectibles: NFTs have transformed the digital art landscape, allowing artists to monetize their work and collectors to own authentic digital assets.

- Gaming: NFTs can revolutionize the gaming industry by introducing true ownership of in-game items and enabling new play-to-earn models.

- Fashion: NFTs can combat counterfeit products by providing verifiable ownership records for luxury goods.

- Events and Ticketing: NFT-based tickets can enhance event security, provide personalized experiences, and facilitate secondary market transactions.

- Domains: NFTs can simplify cryptocurrency wallet addresses by allowing users to own personalized domains, enhancing user experience and security.

NFT Trading Platforms: Gateways to the NFT Market

NFT marketplaces serve as crucial hubs for buying, selling, and trading NFTs. OpenSea, Nifty Gateway, and SuperRare are among the leading NFT marketplaces, each with its unique features and pricing structures.

Top NFT trading platforms

OpenSea

OpenSea, founded in 2017, is the first and leading marketplace for NFT sales. The platform is a decentralized peer-to-peer marketplace for buying, selling and trading NFTs running on the Ethereum blockchain supporting ERC-721 tokens. Furthermore, OpenSea launched a layer-2 scaling solution for Polygon to trade the Ethereum virtual machine (EVM) compatible ERC-721 token at lower gas fees.

It is possible to sell NFTs on OpenSea directly at fixed prices or through auctions. Either way, OpenSea takes 2,5% commission for every transaction happening on the platform. OpenSea also features a tool to mint tokens and accepts over 150 crypto currencies as payment tokens which underlines the platform’s common acceptance in the crypto ecosystem.

Nifty Gateway

Nifty Gateway specialized on expensive, famous and celebrity NFT sales hosted on the Ethereum blockchain. The most expensive NFT, Pax’s “The Merger”, was sold on Nifty Gateway. In comparison to OpenSea, Nifty Gateway is a curated platform that is centrally controlled. Artists must apply at Nifty Gateway in advance which guarantees high-quality offerings.

Nifty Gateway has four different NFT sale methods: online silent auction, global offers, open editions and drawings. For both, online silent auctions and global offers, collectors make a bid or submit an offer, and are then informed whether the bid or offer was accepted.

Open editions means that an unlimited number of NFTs are created for a limited period of time. After the time limit is reached, no more NFTs are issued which leads to scarcity and a stronger market in secondary sales. Drawings can be compared to the concept of entering a lottery as collectors have to win the rights of purchasing an NFT.

Besides accepting common crypto currencies as payment methods, Nifty Gateway offers collectors to pay with credit cards. In addition, Nifty Gateway takes a 5% commission for each transaction, charging artists twice as much as market leader OpenSea.

SuperRare

SuperRare pursues a similar business model than Nifty Gateway as the platform has the intention to create a high-end art gallery focusing on exclusive art. All NFTs offered on SuperRare run on the Ethereum blockchain and comply with the ERC-721 token standard.

According to SuperRare, the marketplace only accepts 1% of the artists applying, hence, SuperRare is a curated platform with central authority. Moreover, artists are permissioned to mint only one of their origins, generating scarcity and rarity.

SuperRare charges 15% gallery fees which is comparably high to other NFT market places. However, considering that ordinary art galleries often charge up to 30% or 50%, SuperRare has a competitive fee.

NFTs in DeFi: Unlocking New Financial Opportunities

NFTs are making inroads into the decentralized finance (DeFi) space, opening up new opportunities for collateralization, fractional ownership, and innovative financial products.

Decentralized Finance

The term Decentralized Finance (DeFi) refers to marketplaces that are not controlled by a central authority. Decentralized applications (dApps) work to replace the role of traditional financial intermediaries . As dApps remove the need for intermediaries, transactions are solely executed by smart contracts. Examples for dApps are peer-to-peer borrowing and lending networks as well as decentralized exchanges (e.g Uniswap).

DeFi networks run on public and permissionless blockchains like Ethereum. Thus, DeFi is commonly referred to as “open finance” as no user verification is necessary. Although dApps can increase the speed and efficiency of transactions, users may face several risks such as default loans.

NFT-backed loans

To reduce the risk of default loans, borrowers are required to deposit a collateral which serves as a guarantee to the lender. Usually, coins are deposited as a collateral excluding illiquide borrowers from DeFi lending opportunities. However, if borrowers lack liquidity but own rare NFTs, they can then use the NFT as a collateral. If the borrower defaults, the same rules apply and the borrower’s NFT is sent to the lender as a collateral.

Fractional ownership

Fractional ownership allows NFT creators to split their tokens into smaller “shares”. Fractionalized NFTs can then be traded on decentralized exchanges or NFT marketplaces. Hence, investors are given the opportunity to buy highly valuable NFTs without having to buy the entire token. This reduces the risk of potential investors being priced out from owning NFTs.

Non-Fungible Tokenss: A Fad or a Sustainable Force?

While the NFT market has experienced significant growth, concerns remain about the sustainability of the hype and the potential for bubbles to form. However, the underlying technology and the diverse range of potential applications suggest that NFTs are here to stay, with the potential to transform the way we interact with digital assets for years to come.

Conclusion: The Future of NFTs

NFTs are poised to play a transformative role in the digital economy, enabling new forms of ownership, access, and monetization. As the technology matures and adoption expands, NFTs have the potential to reshape industries and revolutionize the way we value and interact with digital assets.

Progress of NFT technology, use cases and trading platforms show that NFTs are not only gaining mainstream attention but also awareness from developers and investors. 2021 will be remembered as “the year of the NFTs” due to the explosion in adoption and awareness that the NFT ecosystem gained. These developments stress the importance of NFTs today and in the future.

Taking the whole crypto industry’s history into consideration, we can’t help but wonder whether these recent developments in the NFT market are just a hype. Is the NFT trend a bubble that will eventually burst, similarly to the ICO bubble of 2018 or do NFTs bring long-lasting value that will enable further growth and adoption of this technology?

As we summarized in this article, there are multiple high potential use cases for NFTs. From gaming to digital art, fashion to copyright, NFTs are undoubtedly revolutionizing different industries by bringing significant efficiencies to their processes. This trend seems to be sustainable and an increasing number of players aim at benefiting from the novel and innovative NFT industry.