Table of Contents

Initial Coin Offerings, or ICOs, have become increasingly popular among startups looking to raise funds. This article will cover the basics of ICOs, and guide you through the process of how to launch an ICO. Essentially, an Initial Coin Offering is a fundraising mechanic in which a company issues its cryptocurrency or token, and investors purchase those tokens in exchange for cryptocurrencies like Bitcoin, Ethereum, or stablecoins.

Understanding the Basics of ICOs

Before learning how to launch an ICO, let’s first learn about the basics of ICOs. In their absolute essence, ICOs are like IPOs, but on the blockchain. The token generation and distribution happen on a decentralized and distributed ledger, also known as the blockchain. As opposed to receiving equity in a company like in traditional IPOs, investors participating in ICOs receive digital tokens.

While it is true that businesses are attracted to ICOs as a non-traditional way to raise capital, it is by no means a walk in the park. Due to recent scams in the crypto sphere, investors have become skeptical and more cautious when selecting which projects to support. This ultimately makes it more difficult for new startups to cut through the clutter and gain the needed attention.

The Go-To Checklist Before Launching an ICO

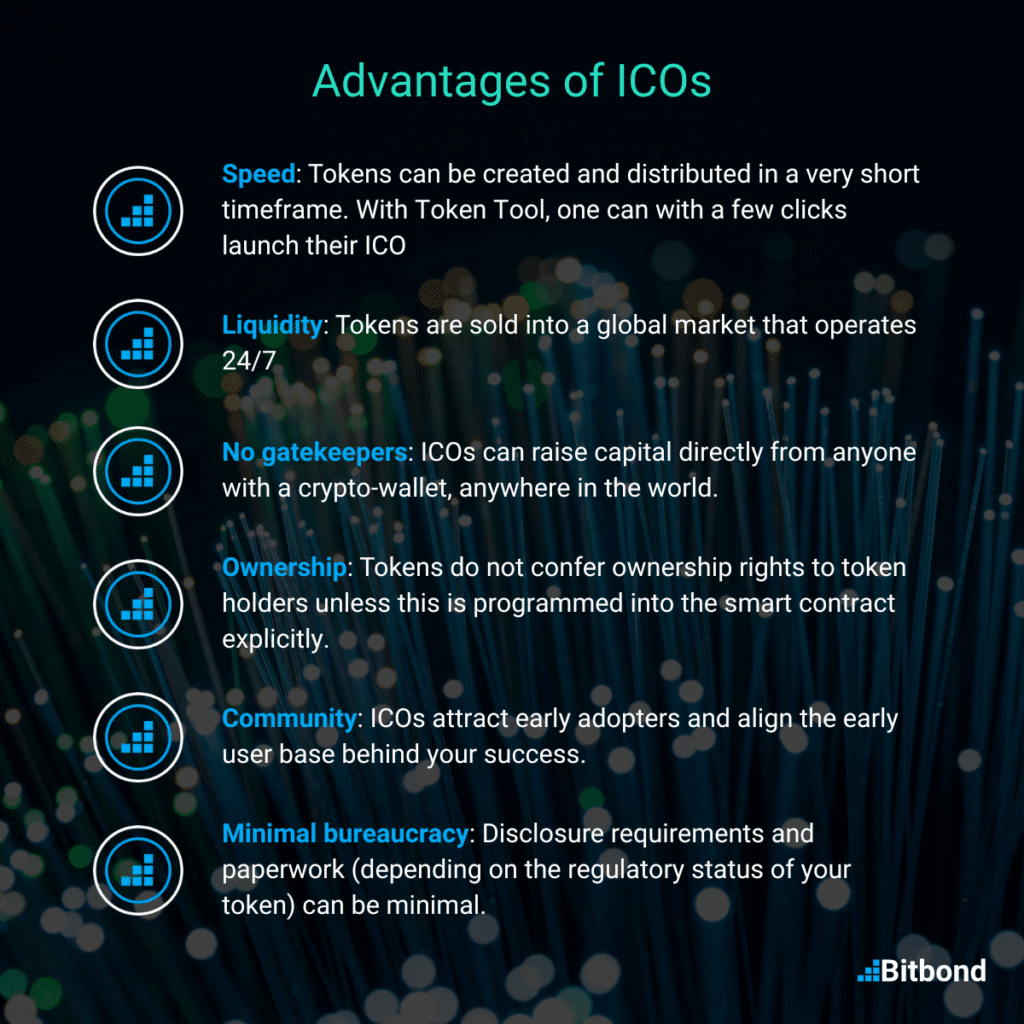

ICOs offer numerous benefits compared to traditional fundraising methods, but before proceeding with your decision to launch an ICO, you should first decide whether it is the right means for your business.

We’ve put together a list of questions to guide you along the way:

- Does blockchain solve your business problem?

- Does your business need a token?

- Can you provide an ongoing value for this token within your dedicated business use case?

- Which jurisdiction should you launch your ICO in?

- Can your token be considered a security?

- Which parts of the ICO will you outsource, and which will you do in-house?

- Which tokenization platform will you use to create and launch your ICO?

Answering these questions at first will allow you to truly reap the benefits of an ICO such as easier access to capital and a more streamlined process.

ICOs offer several benefits over traditional fundraising methods, such as easier access to funds and a faster, non-bureaucratic process, but they also come with certain risks.

It’s essential to highlight these risks before launching an ICO.

Risks of ICOs

- Lack of Regulation: Currently, ICOs are not subject to the same regulations as traditional fundraising methods. This means that scams and fraudulent ICOs are not uncommon, and investors need to exercise caution and do their research before investing in any ICO.

- Volatility: Cryptocurrencies, including ICO tokens, can be highly volatile. This means that the value of your ICO tokens can fluctuate significantly, and investors may be hesitant to invest in a project with uncertain value and unpredictable returns.

- Technical Issues: Developing an ICO requires technical expertise and experience. Technical issues such as bugs or security vulnerabilities in the smart contract can undermine investor confidence and sometimes result in the loss of funds.

Other than the above-mentioned risks, spending time on technical resources to support your ICO launch, will quickly turn into a costly and cumbersome challenge. In addition to an ICO token sale script enabling token offerings, you will need tools to create, manage and distribute tokens and an investor and order submission interface. Token Tool by Bitbond is your all-in-one toolbox for institutional-grade token sale scripts to guide you on your ICO journey.

Types of ICOs

After you’ve decided that an ICO is a right way for your business to raise initial capital, you’ll now need to choose between the two different types of ICOs.

Private ICOs

This type of ICO involves a limited number of investors that you’ll raise capital from. You can also dictate the minimum amount of investment required to participate in the ICO.

Public ICOs

This type of ICO is often referred to as token crowdfunding and it aims to attract institutional investors and the public. It is worth noting that private ICOs are much easier to handle as they involve fewer regulatory complications.

So far, we’ve covered the basics of ICOs, the checklist needed before deciding on your ICO, the risks, and the differences between different ICOs. The next section is dedicated to supporting you on the next steps of your ICO journey.

One of the most important pillars of a successful ICO is investor confidence. Getting noticed by the right people at the right time can be quite challenging in the crypto market. Our team at Bitbond has seen multiple ICOs to date, so we’ve put together a list of must-haves to set your ICO for success.

How to launch an ICO successfully in 5 Steps

Launching an ICO requires careful planning and execution. Here are the 5 key steps to launching an ICO successfully:

1. Develop Your ICO Whitepaper:

Develop a comprehensive whitepaper that clearly outlines your project, its goals, and technical details.

A whitepaper is a critical component of any ICO, as it thoroughly explains the token economy within your system, your product roadmap, your vision, and your team’s expertise. The Ethereum Whitepaper is a great example of a comprehensive that performed significant success. You can find other examples of popular whitepapers in this article.

Here are some tips for creating a great whitepaper:

- Focus on the Problem: Start with a clear explanation of the problem your project is addressing, and why it’s important.

- Explain Your Solution: Provide a detailed explanation of your project’s solution to the problem, and how it works.

- Provide Technical Details: Provide technical details of your project, such as the blockchain technology being used, the token economy, and the smart contract architecture.

- Highlight Your Team: Introduce the key members of your team and their relevant experience.

- Be Clear and Concise: Use clear and concise language to explain your project, and avoid jargon and technical terms that may be unfamiliar to your audience.

- Include Graphics and Visuals: Use graphics, visuals, and diagrams to illustrate your project and make it easier to understand.

- Be Transparent: Provide transparent and accurate information about your project, including its risks and challenges.

Other things to consider:

- Is the ICO well-presented including graphs, use of funds, team allocation, etc.?

- Is it written in a way that best appeals to investors?

- Have you explained your product properly?

- Are the estimates and goals given in the ICO white paper realistically and time-bound?

2. Create a Comprehensive Marketing Strategy for your ICO

Build a community around your project by engaging with potential investors through social media, forums, and events.

Utilize multiple channels, such as social media, community engagement, and press releases, to create awareness and excitement about your project. Harness the power of Web3 Affiliate Programs, engage with influencers, and leverage search engine optimization (SEO) to reach a wider audience.

Forge partnerships with established industry players to boost your project’s credibility and increase adoption. Collaborating with other platforms and projects in the ecosystem demonstrates your project’s ability to work within the crypto community.

3. Choose the Right Token Sale Model for your ICO:

When launching an ICO, it’s important to choose the right token sale model that aligns with your project’s goals and funding needs to ensure success. Here are some of the most popular token sale models:

- Hard Cap: A hard cap model sets the maximum amount of funds to be raised during the ICO. Once that cap is reached, the sale is closed.

- Soft Cap: A soft cap model sets a minimum amount of funds that must be raised during the ICO. If that minimum is not met, the sale is canceled and funds are returned to investors.

- Uncapped Fixed Rate: In this model, tokens are sold at a fixed price throughout the entire ICO, regardless of how much is raised.

- Capped with Fixed Rate: This model sets a maximum amount of funds to be raised, but tokens are sold at a fixed price throughout the ICO.

- Dutch Auction: In a Dutch auction, the token price starts high and gradually decreases over time. Investors can purchase tokens at any point during the auction at the current price.

- Hybrid: A hybrid model combines elements of multiple token sale models to create a unique approach that best fits the project’s needs.

4. Conduct your ICO Token Sale:

Conduct your token sale and distribute the tokens to investors.

Bitbond Token Tool allows users to easily create and launch an ICO by interacting with our Dapp. Our bank-grade tokenization solutions have helped hundreds of renowned financial institutions and SMEs to create and offer tokens for their clients.

5. Manage Your Token Distribution:

Manage your token distribution to ensure that tokens are distributed fairly and efficiently.

During a token presale, a predefined amount of funds is allotted to investors in the form of tokens. If the token presale is successful and the company behind it reaches its target, the tokens become functional units of currency.

As we strive to make blockchain technology widely accessible, tools like Token Tool allow you to create and manage tokens, as well as a token presale, with no coding skills required. Upon conclusion of your token sale, investors can return to the investment page to claim their tokens, streamlining the distribution process.

Conclusion

ICOs have risen in popularity during the last couple of years. As more companies resort to this alternative method of fundraising, more investors are subsequently approaching alternative investment opportunities thanks to the permissionless nature of blockchain technology.

With this rise in popularity, we must however embrace the risks accompanying the technology and raise awareness on how to mitigate them to best optimize for a successful ICO.

Token Tool simplifies the process of asset tokenization and provides an all-in-one solution for businesses looking to launch a successful ICO.

If you’re looking to launch an ICO, but still have a lot of questions unanswered, our team will happily assist you on your journey!

With our Enterprise Solution, our team offers advice on tokenization strategies to assist you throughout every step and ensure the success of your project’s ICO.