Table of Contents

Decentralized Finance Companies: Pioneering a New Economy

Decentralized finance companies, or DeFi companies, are pioneering this transformation, leveraging blockchain technology and smart contracts to democratize finance and make it more efficient and transparent. The digital era has ushered in an array of disruptive technologies, and among them, blockchain stands tall. Its application in decentralized finance, commonly known as DeFi, is fostering an unprecedented financial revolution. This article dives into the catalyst behind DeFi companies, the pros and cons as well as what to look for when selecting your preferred DeFi tool.

Decoding DeFi: The Financial Revolution

DeFi lies at the crossroads of blockchain technology, cryptocurrencies, and traditional finance. Through the potential of blockchain, DeFi eliminates intermediaries such as banks and credit unions, enabling peer-to-peer financial transactions. This approach simplifies transactions, democratizes access, and enhances transparency, all while reducing costs. Smart contracts are the engine that powers these platforms and enables a decentralized ecosystem.

dApps: The Catalysts of DeFi

Decentralized Applications, more commonly known as dApps, serve as the backbone of DeFi. These applications operate on a decentralized network, circumventing any singular authority’s control. They’re not just digital applications shifted onto a blockchain; they’re a reimagining of what apps should be, untethered from centralized entities and vested with the power of decentralization.

Understanding the Mechanics of dApps

Traditional apps rely on a centralized server, essentially a single point of control and, possibly, failure. dApps, however, shatter this mold, operating on a peer-to-peer network that is both resilient and transparent. This decentralized architecture protects against data manipulation, offering transparency that surpasses even the most stringent data regulations. The magic ingredient enabling this is blockchain technology.

The Power of Blockchain in dApps

Blockchain ensures that all transaction data on a dApp is stored across a network of computers, resulting in unmatched data security and transparency. This technology brings essential trust and reliability to the digital world, preventing data breaches and cyber-attacks from causing the sort of havoc we’ve seen in centralized systems.

Harnessing dApps: The Future of Finance

dApps have been causing disruption in various industries, particularly in finance. For instance, platforms like Uniswap and PancakeSwap have turned the tables on traditional exchanges with their decentralized token swaps. Similarly, lending protocols like Aave and Compound have revolutionized borrowing and lending. Tokenization platforms, such as Bitbond’s Token Tool, are democratizing access to asset ownership, fostering a more inclusive economy.

While the use cases may vary across these different DeFi tools, one thing is certain, they’re bringing a paradigm shift to a traditional finance industry that is ripe for disruption.

The Brave New World of Decentralized Finance Companies

Companies like Uniswap, Aave, and Compound, alongside Bitbond, are leading the DeFi revolution. By harnessing the power of dApps, they’re creating a financial system that’s fair, transparent, and open to all. While their operations remain complex, their impact is simple: they’re empowering people to take control of their financial destinies.

The Dark Side of dApps: Scams and Risks

With its tremendous potential, dApps also pose inherent risks. The DeFi landscape, though promising, is still largely unregulated. It has been prone to scams, often through ‘rug pulls,’ where developers vanish after raising funds or smart contract exploits. These occurrences underscore the importance of due diligence when dealing with dApps and DeFi platforms.

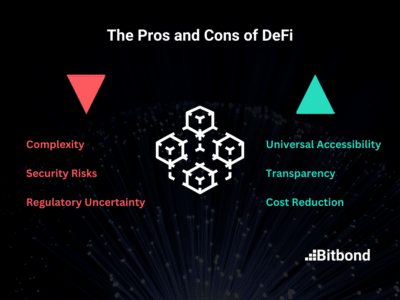

The Pros and Cons of DeFi: A Balanced Perspective

The Advantages of DeFi:

- Universal Accessibility: All you need is an internet connection to access DeFi platforms, making them truly global.

- Transparency: With all transactions recorded on a blockchain, transparency is inherent in DeFi.

- Cost Reduction: By eliminating middlemen, DeFi reduces transaction costs significantly.

However, challenges persist and continue to cause a threat to new users interacting with these protocols.

The Challenges of DeFi

- Complexity: The technical nature of DeFi can deter newcomers.

- Security Risks: Smart contract vulnerabilities can attract hackers.

- Regulatory Uncertainty: The lack of clear regulations can present legal hurdles.

Tokenization: The Next Frontier in DeFi

Asset tokenization, which involves turning physical assets into digital tokens on a blockchain, is gaining popularity. Tokenization brings liquidity, transparency, and accessibility to asset management. Companies like Bitbond are making it easy for businesses to tokenize their assets, enabling them to drive growth through the DeFi space.

TokenTool by Bitbond: Democratizing Asset Ownership

Bitbond’s TokenTool stands out in the DeFi space by providing a simple solution for businesses to tokenize their assets. By breaking down barriers to asset ownership and enhancing market efficiency, TokenTool contributes significantly to the growth of the DeFi ecosystem.

Key Considerations When Choosing DeFi Tools

In the fast-growing DeFi landscape, choosing the right tools can be a daunting task. It is important to consider:

- Censorship Resistance: DeFi tools should be accessible to everyone, regardless of their location or status.

- Permissionless: The ideal DeFi tools allow anyone to create financial instruments without requiring permission from a central authority.

- Transparency: DeFi tools should uphold blockchain’s principle of transparency.

- Interoperability: DeFi tools should be able to operate across multiple blockchain networks.

- Non-custodial: Users should have complete control over their assets and keys.

dApps FAQs: Clearing the Air

Let’s answer some common queries about dApps:

- What’s the difference between an app and a dApp? An app is controlled by a central entity, while a dApp operates on a decentralized network.

- What are some popular dApps? Popular dApps include Uniswap for token exchanges, Compound for earning interest, and Bitbond’s TokenTool for asset tokenization.

- Are dApps safe? While dApps are generally safe, potential scams and vulnerabilities exist due to the unregulated nature of DeFi.

DeFi in Developing Nations: A Beacon of Financial Inclusion

Emerging markets and developing countries stand to benefit enormously from DeFi. Traditional banking systems have often left these regions underserved, with many citizens unbanked or underbanked. DeFi can bridge this gap, providing access to financial services like never before. DeFi companies can offer loans, savings accounts, and insurance products without requiring physical infrastructure, thus reaching remote and underserved populations.

Conclusion: The Dawn of a New Financial Era

Decentralized finance companies are scripting a new narrative for the global financial sector. They’re democratizing access, enhancing transparency, and fostering innovation. Despite the risks and challenges, the vision of an inclusive, efficient, and decentralized financial system is becoming more real each day. As the world begins to embrace this new financial era, the journey of DeFi is only just beginning.