Table of Contents

Decoding the Utility Token Crypto: A Deep Dive into Its Function and Comparison with Security Tokens

Understanding Utility Token Crypto

A cornerstone of the blockchain ecosystem, utility tokens offer more than just a medium of exchange; they are the keys to accessing myriad services and functionalities within decentralized platforms. These tokens, often issued during Initial Coin Offerings (ICOs), provide users with specific advantages like discounted fees, voting rights in governance, or exclusive access to a service. Unlike traditional investments, utility token crypto is not primarily designed for direct financial return but for utility within a specific ecosystem. For instance, a token might grant its holder access to a decentralized file storage network or a blockchain-based gaming platform.

Bitpanda Academy notes that utility tokens form the backbone of many blockchain-based services, driving user engagement and fostering a participatory economy within the digital realm.

Utility Tokens in ICOs and Token Sales

The rise of ICOs has been synonymous with the proliferation of utility tokens in crypto. These crowdfunding events allow startups to unlock capital by issuing tokens that participants can purchase, typically with other cryptocurrencies like Bitcoin or Ethereum. However, the true allure of these tokens lies in their application within the issuer’s platform. For example, a project might issue tokens that users can redeem for premium features or as a voting right in project development decisions.

Token Tool by Bitbond exemplifies this concept, offering businesses and creators an intuitive platform to create and launch their utility tokens with no code required. By providing a user-friendly interface and robust support, Token Tool ensures that even those new to the blockchain space can efficiently tap into the power of tokenization for their projects.

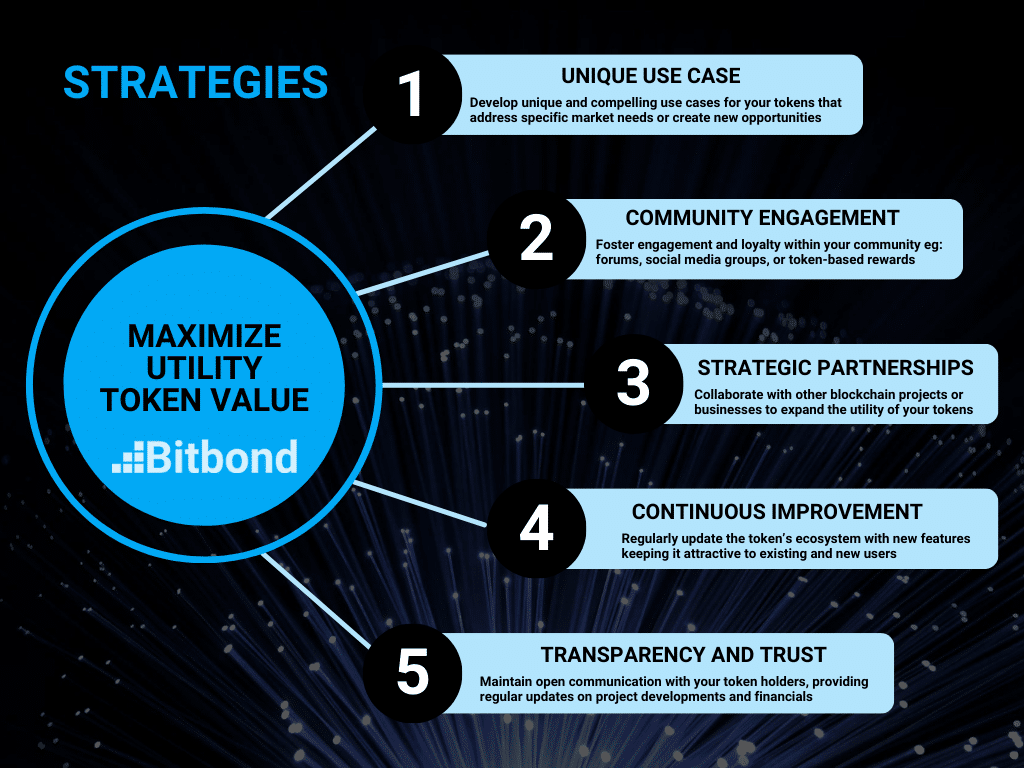

Key Strategies for Maximizing Utility Token Value

Utility tokens aren’t just digital assets; they are pivotal in adding real value to blockchain projects. To maximize their potential, consider the following strategies:

- Innovative Utility Token Use Cases: Develop unique and compelling use cases for your tokens that address specific market needs or create new opportunities.

- Community Engagement Around Utility Tokens: Build a strong community around your token, fostering engagement and loyalty. This can include forums, social media groups, or token-based rewards for active community members.

- Strategic Partnerships: Collaborate with other blockchain projects or traditional businesses to expand the utility and reach of your tokens.

- Continuous Improvement: Regularly update the token’s ecosystem with new features or enhancements, keeping it relevant and attractive to existing and new users.

- Transparency and Trust: Maintain open communication with your token holders, providing regular updates on project developments and financials.

Comparing Utility Tokens and Security Tokens

While utility tokens focus on providing access or services within a blockchain ecosystem, security tokens represent an investment in an asset or enterprise, akin to traditional securities. Security tokens often signify ownership or a share in the issuing entity and are subject to strict regulatory compliance, much like stocks or bonds. In contrast, utility tokens, largely unregulated, offer use-case-based benefits but do not typically confer ownership or equity in a company.

Understanding these distinctions is crucial for both creators and investors to navigate the regulatory landscape and align their strategies with the token’s intended purpose.

The Regulatory Landscape around Utility and Security Tokens

The regulatory framework for utility and security tokens differs significantly. Security tokens are subject to securities laws, requiring compliance with regulations like the U.S. Howey Test, which determines if a token is an investment contract. In contrast, utility tokens, are largely unregulated, though this is changing as authorities begin to pay closer attention to the cryptocurrency space. This evolving landscape makes it essential for issuers to stay informed and compliant, particularly when navigating international markets. Understanding the different regulations is crucial for issuers and investors to navigate potential legal challenges.

- Different Jurisdictional Approaches between the US and EU around Utility Tokens: Different countries have distinct regulations for utility tokens. For instance, the U.S. Securities and Exchange Commission (SEC) may treat certain utility tokens as securities based on their use and distribution, applying the Howey Test to determine their status. In contrast, the European Union is working on comprehensive digital asset regulations under its proposed Markets in Crypto-Assets (MiCA) framework.

- Compliance and Legal Challenges: Companies issuing utility tokens must navigate a maze of regulatory requirements, ensuring they do not inadvertently fall under securities laws. This involves careful structuring of the token’s functionalities and sale methods to differentiate them from investment instruments.

- Ongoing Regulatory Developments: The U.S. is actively working on clearer guidelines for digital assets, while countries like Switzerland have established more defined frameworks for blockchain-based tokens.

The Future Landscape of Utility Tokens

The trajectory of utility tokens is marked by continuous innovation and expansion. Here’s what we can expect in the future:

- Increased Adoption: Utility tokens will likely see broader adoption across various industries, from gaming to healthcare.

- Regulatory Clarity: As the market matures, clearer regulations will emerge, providing a more stable environment for utility token development.

- Technological Advancements: New technologies will enhance the functionality and scalability of utility tokens, further integrating them into the digital economy.

- Wider Acceptance: Expect a shift in public perception as crypto utility tokens become more mainstream, similar to the evolution of cryptocurrencies like Bitcoin and Ethereum.

- Integration with Traditional Systems: Utility tokens will increasingly interface with traditional financial systems, bridging the gap between conventional and digital finance.

An example of utility tokens integrating with traditional systems is their use in loyalty reward programs. For instance, a retail chain could issue utility tokens as part of its customer loyalty program. Customers earn tokens through purchases, which can then be redeemed for discounts, special offers, or exclusive access to products. This bridges the gap between conventional reward systems and blockchain technology, offering a digital, secure, and versatile approach to customer engagement and retention.

Conclusion: Navigating the Utility Token Space

Utility tokens represent a dynamic and evolving aspect of the blockchain world. As we look to the future, tools like TokenTool by Bitbond provide the necessary platform to create, manage, and maximize the potential of these tokens. For businesses and individuals alike, understanding and leveraging utility tokens can open doors to innovative opportunities and a deeper engagement with the digital economy. Whether you’re a seasoned blockchain enthusiast or new to the space, check out how TokenTool can empower your journey to launch your very own utility token.