Table of Contents

The world of cryptocurrency can be complex, but understanding what “crypto staking” is doesn’t have to be. Staking is simply the process of locking up your cryptocurrency holdings to support a blockchain network and earn rewards in return. It’s similar to earning interest on your savings account, but in the crypto world.

What is “Crypto Staking”?

Corporate and investment banks, asset managers, institutional investors, family offices, and other market participants are becoming increasingly driven by technology and institutions are evolving to match the shifting clients demand (check our report on “Institutional adoption of digital assets 2021”).

It is fair to say that a lot of things in the crypto world can be complicated ideas or rather simpler ones depending on the level of understanding that you wish to unlock. This statement remains true when it comes to understanding what is crypto staking. For most, the constituent that staking allows the earning of rewards for holding certain cryptocurrency is the only factor that matters. However, if you are only looking to earn some staking rewards, it remains interesting to understand why and how the system behind it works.

How does Crypto Staking work?

Crypto staking happens when a user decides to lock or hold their funds in a crypto wallet to participate in maintaining the operations of a proof-of-stake (PoS) based blockchain system. The reward of staking comes from the user helping the network achieve consensus. It is to some extent comparable to mining on a Proof-of-Work (PoW) platform

When you stake your crypto, you essentially become a validator on the network. This means you help verify new transactions and maintain the security of the blockchain. In exchange for your contribution, you earn rewards in the form of new cryptocurrency.

Why do only some cryptocurrencies have staking (PoS vs PoW)?

Not all cryptocurrencies use staking. Staking is primarily used by blockchains that rely on a “Proof of Stake” (PoS) consensus mechanism. This is different from the “Proof of Work” (PoW) system used by Bitcoin, which requires miners to solve complex mathematical problems to earn rewards. PoS is generally considered to be more energy-efficient and environmentally friendly than PoW.

It depends on the underlying blockchain consensus mechanism.

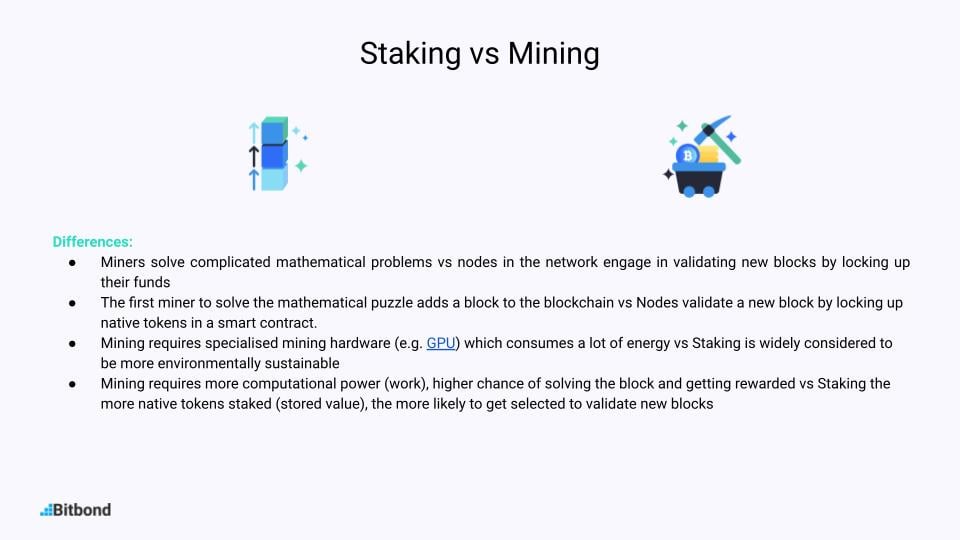

- Staking is mainly used as mentioned above for Proof-of-Stake (PoS) i.e. ETH 2.0 while mining is used for Proof-of-Work (PoW) i.e. Bitcoin

- Mining and Staking have thus major differences mainly due to the structure/purpose of their blockchain consensus mechanism:

- Miners solve complicated mathematical problems vs nodes in the network engage in validating new blocks by locking up their funds

- The first miner to solve the mathematical puzzle adds a block to the blockchain vs Nodes validate a new block by locking up native tokens in a smart contract.

- Mining requires specialised mining hardware (e.g. GPU) which consumes a lot of energy vs Staking is widely considered to be more environmentally sustainable, saving over 99% of energy consumption according to Vitalik Buterin

- Mining requires more computational power (work), higher chance of solving the block and getting rewarded vs Staking the more native tokens staked (stored value), the more likely to get selected to validate new blocks

In a PoS network, validators (as they’re often known) are chosen by the network depending on the size of their stake and the length of time they’ve held it. As a result, the participants who have put the most effort in are rewarded. In a slashing event, users can have a portion of their stake burnt by the network if transactions in a new block are deemed to be invalid.

Another consensus for staking: Delegated Proof of Stake (DPoS)?

Daniel Larimer created in 2014 the Delegated Proof of Stake(DPoS), an alternative version of the PoS method. It was first implemented as part of the BitShares blockchain, but other networks quickly followed suit. Steem and EOS are two of these.

Users can commit their coin balances as votes with DPoS, with voting power proportional to the number of coins owned. These votes are then used to elect delegates who govern the blockchain on behalf of their constituents, ensuring security and consensus. Staking awards are typically awarded to elected delegates, who subsequently distribute a portion of the benefits to their voters proportionally to their individual contributions.

With the DPoS approach, consensus can be reached with a smaller number of validating nodes. As a result, it improves network performance. On the other hand, because the network relies on a limited, chosen number of validating nodes, it may result in a lower degree of decentralization. These validating nodes are in charge of the blockchain’s operations and general governance. They take part in the process of achieving an agreement and defining important governance parameters.

Simply put, DPoS allows users to signal their influence through other participants of the network.

What Can I Stake?

Users who wish to make passive income with their idle crypto-assets now have a plethora of possibilities thanks to the growing popularity of staking. We’ll go over some of the most popular cryptocurrencies that currently offer staking rewards:

Ethereum 2.0

Ethereum 2.0 is one of the most popular staking choices, as Ethereum is the second-most popular cryptocurrency platform to date. You can also assist the system thrive by being one of its early validators if you have an ETH investment.

In order to stake on ETH 2.0, you need to own a minimum of 32 ETH, as well the Eth1 mainnet client. Start by heading over to the Eth2 Launch Pad.

Tezos (XTZ)

Tezos was launched in June 2018, sparking a great uproar as the world’s largest initial coin offering (ICO), with over $230 million in funding. It uses a type of proof-of-stake known as liquid proof-of-stake (LPoS).

Tezos’ native currency, XTZ, refers to the staking process as “baking.” The native coin is used to reward bakers. Bakers who are spiteful are also punished by having their stake taken.

A user must own 8,000 XTZ coins and run a complete node on Tezos to become a staker/baker. Third-party platforms have fortunately evolved, allowing small coin holders to delegate little XTZ amounts and share baking benefits. The annual percentage yield on XTZ staking is in the range of 5% to 6%.

Algorand (ALGO)

The fundamental goal of Algorand is to promote low-cost cross-border payments. The network requires stakers for security and transaction processing because it is a PoS protocol. It uses the pure proof-of-stake (PPoS) consensus process, unlike Tezos. Stakers, on the other hand, are still required to run complete nodes.

Furthermore, ALGO delegation is backed by third parties. On these networks, staking payouts range between 5% and 10% each year. It’s important to note that the incentives are determined by the platform. Binance Staking, for example, offers an APY (annual percentage yield) of 8% to individuals that use it.

COSMOS (ATOM)

Founded in 2016, COSMOS offers an ecosystem of connected blockchains. ATOM tokens are earned through a hybrid proof-of-stake algorithm, and they help to keep the Cosmos Hub, the project’s flagship blockchain, secure. This cryptocurrency also has a role in the network’s governance.

Typically, staking rewards on this network stands at 9.7% annually excluding validators commission that can average 10.28%.

Staking Stablecoins

Staking stablecoins is a great way to hold your funds in the current low interest rate environment and earn yields while avoiding market volatility. Here are some of the stablecoins yields across top exchanges:

- USDC: 3.49% in Binance, 0.15% in Coinbase, 3.23% in OKEx

- BUSD: 3.59% in Binance

- DAI: 2% in Coinbase, 7.4% in Gemini, 4.12% in OKEx

- USDT: 5.47% in Binance, up to 13.93% in OKEx

Where Can I Stake?

There are several ways to stake your cryptocurrency:

- Exchanges: Many popular exchanges, such as Binance and Coinbase, offer staking services. This is a convenient option, but it’s important to choose a reputable exchange.

- Wallets: Some cryptocurrency wallets, like hardware wallets, also allow you to stake your coins. This can be a more secure option than staking on an exchange, but it may require more technical knowledge.

- Staking-as-a-Service Platforms: These platforms offer staking services for a fee. They can be a good option for beginners who don’t want to deal with the technical aspects of staking themselves.

Exchanges

Due to the large number of users on their platforms, exchanges have inevitably jumped into the staking business.

Traders can diversify their revenue streams and monetise their idle funds on exchanges by staking. Staking is supported by a number of popular cryptocurrency exchanges, including but not limited to:

Binance

By trading volume, Binance is the largest digital currency exchange. As a result, when it comes to staking through trading platforms, many investors put it at the top of their list. In line with this, the Binance staking service for Ethereum 2.0 came to life in December 2020.

In addition, DeFi staking is supported by the exchange, which accepts DAI, Tether (USDT), Binance USD (BUSD), BTC, and Binance Coin (BNB).

Coinbase

Coinbase is another popular cryptocurrency exchange where you may invest in a variety of coins. Other coins supported by Coinbase staking include ALGO and XTZ, in addition to ETH 2.0.

Cold/Private Wallets

Staking on a wallet that isn’t linked to the Internet is known as cold staking. This can be done using a hardware wallet, but an air-gapped software wallet can also be used.

Users can stake while their assets are safely held offline on networks that enable cold staking. It’s important to note that if a stakeholder takes their money out of cold storage, they will no longer receive rewards.

Cold staking is especially important for significant stakeholders who want to ensure that their funds are fully protected while still supporting the network.

Leading offline/private cryptocurrency wallets supporting staking include:

- Ledger – Ledger is the industry leader for cold wallets. Hardware wallets have the advantage of allowing you to keep full control of your coins when staking.

- Ledger also allows users to stake up to seven coins on top of its security. Tron (TRX), ATOM, and ALGO are some of the supported coins for staking.

- Trust Wallet — Binance’s Trust Wallet is a multi-purpose private wallet. By staking XTZ, ATOM, VeChain (VET), TRX, IoTeX (IOTX), ALGO, TomoChain (TOMO), and Callisto (CLO), users can receive a passive income.

- CoolWallet S — The first Bluetooth mobile hardware wallet. Through its X-Savings feature, CoolWallet S provides stablecoin (USDT) staking in-app.

- Trezor — The world’s oldest hardware wallet now supports staking of select assets, such as Tezos, via third-party apps such as the Exodus wallet.

Crypto Staking-as-a-Service Platforms

Soft staking is another solution to access staking services. Unlike cryptocurrency exchanges and wallets, which serve as both trading and storage platforms, staking-as-a-service platforms are solely for staking. However, to offset their costs, these platforms deduct a percentage of the prizes obtained.

- Stake Capital – It supports the staking of Loom Network (LOOM), KAVA, XTZ, Aion (AION), Livepeer (LPT) and Cosmos (ATOM).

- MyCointainer – MyCointainer users choose between Power Max, Power Plus and Basic options when staking their virtual assets. The three levels depict the staking charges.

- Basic customers, for example, pay as little as $1 per month, whereas Power Max users spend more than $10 per month. With on-chain staking support, the platform supports the staking of more than 50 cryptocurrencies.

DeFi Crypto Staking

To check yields from DeFi staking, go over to the staking calculator webpage.

- AAVE (AAVE) – The platform allows users to supply and borrow crypto assets, and earn yield on assets supplied to the protocol. Yield on any supplied crypto assets adjusts automatically and algorithmically based on supply and demand in the protocol. (currently number one in total volume locked (TVL) as of September 2021).

- Maker (MKR) – Users can borrow stablecoins against a volatile cryptocurrency like Bitcoin on the site. It has become one of the most popular decentralized finance protocols on the Ethereum blockchain due to its widespread use. Notably, DAI is the network’s principal stablecoin. As a result, yield farmers deposit DAI, which is then lent to borrowers, and they profit from the interest paid on the loans.

- Synthetix (SNX) – SNX is the native currency of Synthetix. The platform is used to issue synthetic assets, often known as Synths, as its name suggests. Synths are virtual assets that are used to mimic physical and real assets like stocks, cryptocurrencies, and fiat currency.

- Yearn Finance (YFI) – As a DeFi aggregator, the protocol was created in February 2020. As a result, rather than facilitating lending and borrowing, it distributes deposited assets to platforms that offer the best returns and have lower risk profiles. For example, it divides funds between Aave and Compound whenever it determines that these two offer the most profitable and risk-free returns.

- Compound (COMP) – Users can borrow and lend a restricted number of cryptocurrencies, including ETH, USD Coin (USDC), Basic Attention Token (BAT), Ethereum (ETH), and DAI, through Compound. Lending pools are used on the site, and loans are charged interest. Borrowers must deposit a certain quantity of supported coins as collateral, according to the protocol.

How to Choose a Staking Platform

Before you start staking, it’s important to carefully choose a platform. Here are some things to consider:

- Reputation: Choose a platform with a good reputation and a proven track record.

- Security: Make sure the platform has strong security measures in place to protect your assets.

- Fees: Compare the fees charged by different platforms before making a decision.

- Minimum Stake: Some platforms have a minimum amount of cryptocurrency that you need to stake in order to participate.

How to Stake Crypto?

The method for staking digital currencies is determined on the staking option you choose. Cold staking, for example, is not the same as being a validator on a PoS network. Furthermore, staking-as-a-service platforms are not the same as third-party or exchange-based staking.

Staking on an exchange

Exchanges are the most straightforward point of entry for potential staker. The process is rendered really simple.

- Indicate the amount of coins you would like to stake and validate the decision

- The exchange will find a validating node on your behalf

- Exchanges often involve simply leaving stackable assets in the wallet of the trading account

Where Can You Earn The Highest Staking Rewards on Exchanges?

Here are some of the top exchanges where you may receive the highest staking incentives as of September 30, 2021:

- Binance: 5.86% for BNB, 9.20% for SOL, 11.34% for MATIC, 5.09% for ADA, 11.51% for DOT, 14.79% for KSM and 70 more (some are locked staking, with duration ranging from 15 to 90 days)

- Coinbase: 5% for ETH, 4% for ALGO, 5% for ATOM, 4.63% for XTZ and more

- Kraken: 5-7% for ETH, 12% for DOT, 4-6% for ADA, 7% for ATOM, 5.5% for XTZ and more

- Gemini: 2% for ETH, 7.4% for DOGE, 6.42% for 1inch, 7.4% for DAI, 5.44% for GRT and more

- OKX: up to 12.92% for ETH, 16.65% for DOT, 14.5% for MATIC, 14.05% for ATOM, 11.89% for XTZ and more (yields depend on staking on flexible or fixed terms)

Staking On a Hardware Wallet

Staking crypto on a hardware wallet like Ledger is equivalent to stacking on a platform in terms of simplicity. You can utilize the coins in your Ledger wallet, but manage the crypto using other wallet apps.

Where Can You Earn The Highest Staking Rewards on a Hardware Wallet?

Here are some of the top hardware wallet where you may receive the highest staking incentives as of September 30, 2021:

- Ledger: 6% for XTZ, 7% for TRX, 8-10% for ATOM, 5-6% for ALGO and 10% for DOT (yields are an estimate and have not taken into account validator’s fees or commissions)

- Trezor: Trezor wallet does not support direct staking on its UI. However, you can connect to wallet apps like Exodus. Yields are 9.65% for ATOM, 4.87% for ALGO, 4.91% for ADA, 5.66% for XTZ and more

How are staking rewards calculated?

The way staking rewards are calculated can vary depending on the specific blockchain network. Some factors that can affect rewards include:

- How many coins the validator is staking

- How long the validator has been actively staking

- How many coins are staked on the network in total

- Inflation rate

- Other factors

Staking payouts on several other networks are set at a preset percentage. As a form of inflation compensation, these payments are provided to validators. Inflation encourages people to spend their money rather than save it, which could lead to an increase in cryptocurrency usage. Validators, on the other hand, can use this model to compute the exact staking payout they can expect.

Some people may prefer a predictable payout schedule over a stochastic probability of obtaining a block reward. And, because this is public information, it may encourage more people to participate in staking.

What are the advantages & disadvantages of crypto staking?

Avantages:

- Staking is seen by many long-term crypto investors as a method to make their assets work for them by creating profits rather than accumulating dust in their wallets.

- Staking also contributes to the security and effectiveness of the blockchain projects you support. By staking a portion of your funds, you increase the blockchain’s ability to withstand attacks and conduct transactions. (Some projects also provide staking members “governance tokens,” which give them a say in future protocol updates and upgrades.)

- Low barrier to entry. Staking is easy and can be done in a few simple clicks, especially with major exchanges now offering staking services. Users do not need a huge amount to get started (thanks to staking pools)

- Staking is also energy efficient.

Disadvantages:

- Staking frequently necessitates a lockup or “vesting” period, during which your cryptocurrency cannot be transferred for a set length of time. This can be a disadvantage because you won’t be able to swap staked tokens even if prices change during this time. Before you start staking, make sure you understand the individual staking requirements and guidelines for any project you’re interested in

- Possibility of hacking/cyber attacks on the protocol or exchange – this is the main reason some crypto investors stake on hardware wallets

- Validator nodes holding your staked tokens may be penalised if it does not uphold 100% uptime in processing transactions

What is a crypto staking pool?

Crypto staking pools allow multiple individuals to pool their resources together to increase their chances of earning staking rewards. This can be a good option for individuals who don’t have enough cryptocurrency to stake on their own.

I hope this improved version of the content is easier to understand and provides a clearer overview of crypto staking.