Table of Contents

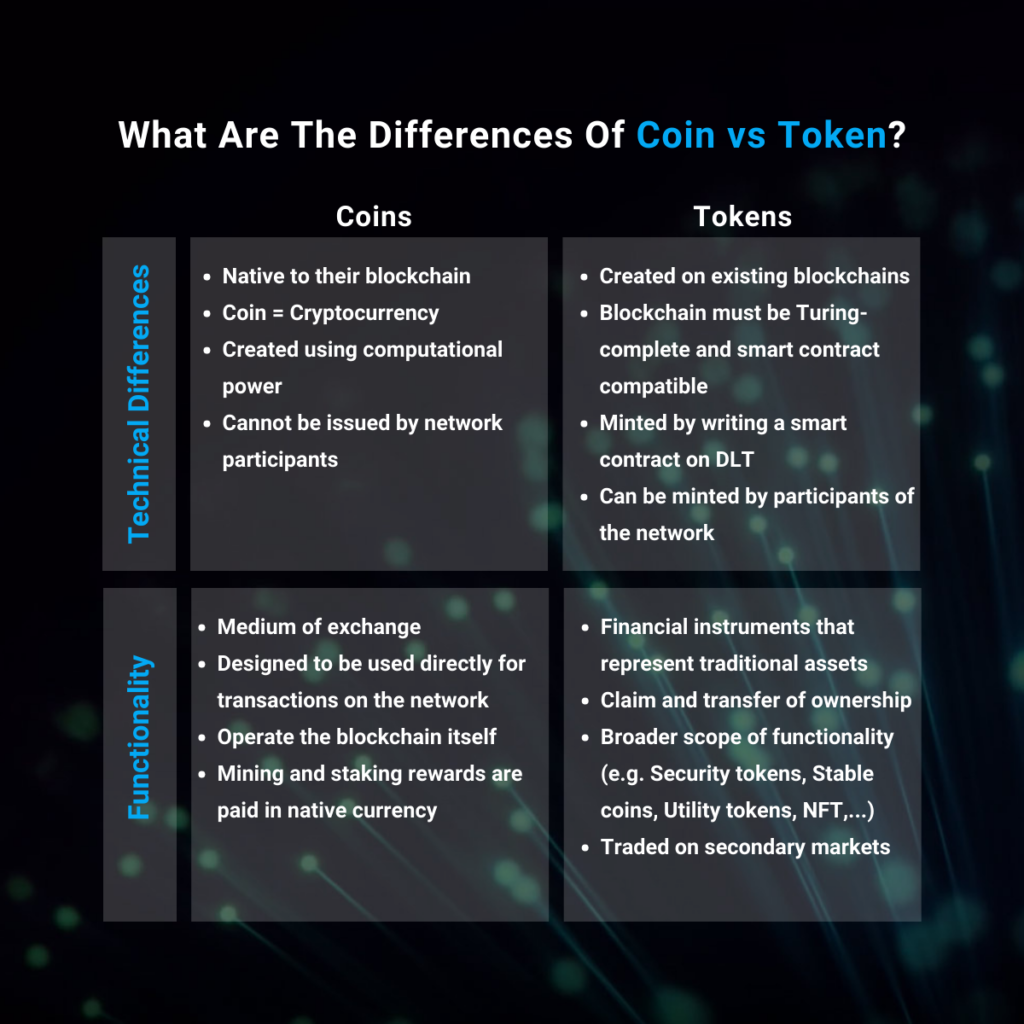

The terms “coin” and “token” are often used synonymously. However, they greatly differ from a technical perspective, as well as from a functional perspective. Coins are primarily used as a medium of exchange, whereas tokens are mainly used to claim ownership or grant rights. Because tokens can be issued and managed on existing blockchains, they have a much broader scope of functionality.

What exactly is a coin?

The most important technical difference between coins vs tokens is that coins are native to the blockchain they run on. Coins operate and function on their own blockchain and are therefore primarily used to store value and serve as a medium of exchange.

Coins are used to operate the blockchain itself. Hence, coins function as the instrument with which transaction fees and other operations are paid. Consequently, native coins are always the cryptocurrency of the blockchain they run on. Ether (ETH), for example, is the native coin – and therefore the cryptocurrency – of the Ethereum protocol.

The creation of Bitcoin, and later other currencies, enabled efficient global transactions and the digital transfer of value. Thus, coins are primarily designed to function pretty similar to fiat money. For instance, coins are used to purchase other digital assets such as NFTs or traditional assets.

Crypto coin transactions are handled by the blockchain itself. When a coin is sent from one user to another, the transaction is recorded on the blockchain. The balance of the investors’ wallet is updated accordingly as they receive the asset. Since crypto coins are digital currencies, funds simply move from one wallet to another without being physically transferred.

In comparison to tokens, coins can only be created by the protocol itself and are limited in supply. In order to earn coins, members of the network must mine or stake the respective cryptocurrency, depending on the consensus mechanism of the coin’s blockchain. Miners can earn mining rewards by contributing to Proof-of-Work (PoW) networks, and coin holders earn staking rewards by validating nodes for Proof-of-Stake (PoS) protocols.

Summary of the 5 main characteristics of a coin:

- Native to the blockchain they run on

- Used to operate the blockchain itself

- Similar to fiat money, coins are fungible and uniform

- Widely accepted as a medium of exchange

- Limited and predefined supply encoded in the coin’s protocol

What is the difference of coin vs tokens?

Contrary to coins, tokens do not need an independent blockchain in order to be created. All chains that support smart contracts can be used to issue a token. Therefore, tokens can be issued on various blockchains such as Ethereum, Stellar, Polygon and Binance Smart Chain. Tokens are minted by writing a smart contract executed on a distributed ledger technology (DLT).

Tokens that are compatible with several blockchain protocols are not necessarily bound to the blockchain on which they were issued. Thus, they can be transferred from one chain to another. One example for tokens that can be allocated to a different chain are tokens that were issued on an Ethereum Virtual Machine (EVM) compatible protocol. It is possible to move a token that has been issued on Polygon to the Ethereum, Avalanche or Binance Smart Chain. However, tokens that have been issued on non-EVM compatible blockchains, cannot be transferred to the Ethereum network yet.

Smart contracts only work on Turing-complete protocols, so tokens can only be minted on blockchains that are Turing-complete. This means that the code must be able to solve exceptionally complex tasks and covers a broad range of functionalities. Due to their technological complexity, Turing complete protocols are more error-prone than non-Turing-complete protocols.

What are altcoins?

Altcoins

In short, all cryptocurrencies other than Bitcoin (BTC) are referred to as alternative coins “altcoins”. Similar to BTC, Altcoins are also native to their blockchain, however, they differ from BTC with regards to the development process and functionality. Most Altcoins are a modified version of BTC coins. To differentiate from Bitcoin, altcoins often use different consensus mechanisms and governance rules. This allows altcoins to offer various different performance features such as smart contracts.

Technically, well established coins like ETH still fall under the definition of altcoins. However, they are increasingly excluded from that definition. It is argued that the market share of some altcoins like ETH is significant enough to not classify them as alternative coins anymore.

Functionality & Applications of Tokens

Tokens are financial instruments that represent tradable assets such as digital files. They are mainly used to claim and transfer ownership of the financial asset that they represent. It is possible to purchase tokens with coins, trade them on secondary markets and stake them to earn interest.

The most important types of tokens

Due to the flexibility of smart contracts, all variations of payment profiles can be created. Here are the most important types of tokens:

Security Token

Security tokens are financial instruments and value carriers that replace the paper certificate of securities. Analog to paper-based units, security tokens can be traded on secondary markets for example on marketplaces and security exchanges. For that reason, security tokens can be seen as the “blockchain version” of traditional financial securities.

Bitbond’s security token offering (STO) in 2019 can also be used to illustrate the concept of security tokens. When Bitbond issued its tokenized bond, it was the first regulated STO in Germany. Since 2019, there has been a tremendous increase in the number of security token offerings. Today, the total market capitalization of tokenized securities exceeds $3.6 bn.

Stablecoins

Stablecoins are tokens that are linked to one or more fiat currency. As they are backed 1:1 to fiat money, stablecoins are also commonly called “e-money”. One example for a stablecoin is the USDC coin as you can always redeem one 1 USDC for 1 USD.

Utility Token

Different from security tokens, utility tokens are blockchain-based digital representations of rights rather than ownership. Utility tokens can entitle the holder to certain rights such as access to a network.

Non-Fungible Tokens (NFTs)

Non-Fungible Tokens are mainly used to represent ownership of unique collectibles. The holder of the token is the only official owner at that time. NFTs are issued on the blockchain with an immutable record of ownership. To prevent NFTs from being replicated, ownership is managed through unique identification codes and metadata.

Conclusion

To keep coins and tokens apart, you can think of coins as being the money needed to purchase digital assets. Tokens, on the other hand, represent specific assets and are used to claim ownership or grant rights to the holder. The difference in functionality can be explained through their opposing technical basis. Because tokens are issued by writing a smart contract on an existing blockchain, there is great flexibility in design and function. Thus, tokens can be used to represent various assets including securities, rights and digital assets.