Table of Contents

The financial landscape is undergoing a profound transformation, driven by the emergence of security tokens, a new class of digital assets that represent ownership of real-world securities. These innovative tokens, built on the foundation of blockchain technology, hold the potential to revolutionize capital markets, unlocking a plethora of benefits for issuers, investors, and intermediaries alike. Blockchain security tokens represent tokenized version of regulated financial instruments and are usually sold through a Security Token Offering (STO).

Tokenization of assets is gaining in popularity. BlackRock CEO Larry Fink said in an interview that “the next generation for markets, the next generation for securities, will be tokenization of securities”. Traditional processes in capital markets are highly inefficient. Blockchain technology solves pain points that issuers and financial institutions face in regards to transfer, settlement and custody of assets.

Unlocking the True Potential of Security Tokens: A Paradigm Shift in Capital Markets

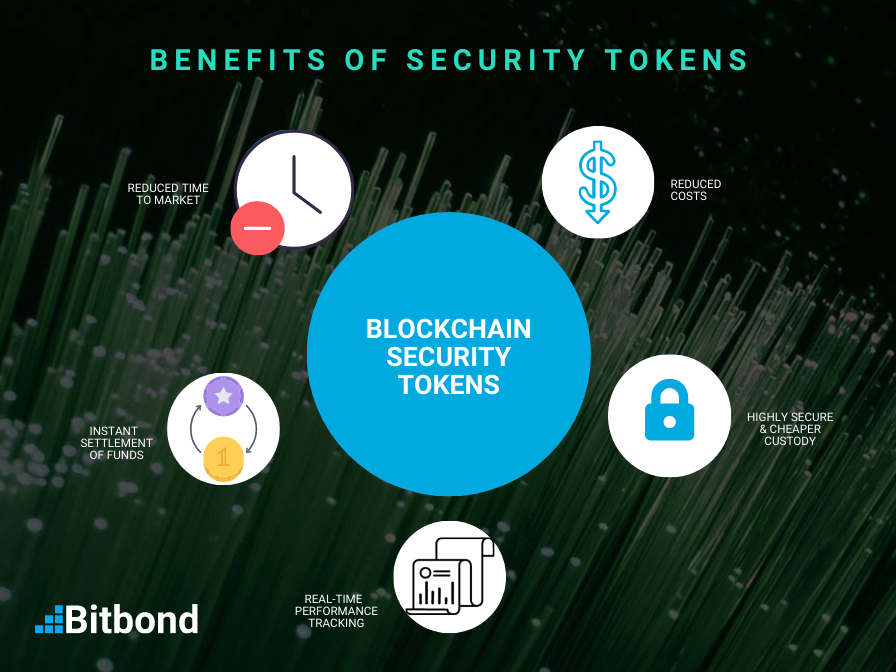

Security tokens offer a compelling suite of advantages over traditional securities, paving the way for a paradigm shift in the financial industry. Here’s a glimpse into the transformative power of security tokens:

- Enhanced Liquidity and Efficiency: Security tokens dissolve the liquidity barriers that often hinder traditional securities. They can be traded seamlessly on decentralized exchanges, eliminating the need for intermediaries and fostering increased accessibility for a broader range of investors.

- Cross-Border Seamless Transactions: Blockchain technology transcends geographical boundaries, enabling frictionless transfer of security tokens across borders. This groundbreaking capability eliminates the complexities and inefficiencies associated with traditional cross-border transactions, empowering investors to participate in global markets with ease.

- Fractional Ownership and New Payment Mechanisms: Security tokens democratize access to previously inaccessible investment opportunities. By enabling fractional ownership, investors can acquire shares in assets with smaller amounts of capital, opening doors to a wider range of investment options. This innovation also paves the way for new payment mechanisms, such as fractionalized payments, which reduce counterparty risk and enhance liquidity.

- Enhanced Security and Compliance: Blockchain technology is inherently secure, providing an immutable and transparent record of ownership and transactions. Security tokens, embedded in this secure infrastructure, offer a robust defense against fraud and manipulation, fostering trust and confidence in the digital asset ecosystem.

The benefits of security tokens bring disruptive added value to capital markets’ transactions.

Real-World Examples of Security Tokens

The transformative potential of security tokens is already being realized in various industries:

- Real Estate: Security tokens are tokenizing real estate assets, enabling fractional ownership and facilitating more efficient transactions. For instance, the German company Propellr has issued security tokens representing ownership interests in commercial real estate properties.

- Art and Collectibles: Security tokens are transforming the art and collectibles market, providing a secure and transparent platform for trading valuable assets. For example, the company ArtPass has issued security tokens representing ownership interests in rare and valuable artworks.

- Private Equity: Security tokens are democratizing access to private equity investments, allowing smaller investors to participate in deals that were previously exclusive to institutional investors. For instance, the company Securitize has issued security tokens representing ownership interests in private equity funds.

- Debt Instruments: Security tokens are revolutionizing debt financing, providing a more efficient and cost-effective way for companies to raise capital. For example, the company TokenSoft has issued security tokens representing debt obligations of companies like Filecoin.

Find out more about all possible tokenization use cases.

Driving Wider Adoption: A Multi-Faceted Approach

The widespread adoption of security tokens requires a concerted effort:

- Regulatory Progress: Clear and comprehensive regulatory frameworks, such as the European Union’s Markets in Crypto-Assets (MiCA) initiative, eWpG, are crucial to foster a supportive environment for innovation and encourage institutional adoption.

- Reliable Tech Vendors: Financial institutions need experienced and compliant blockchain technology vendors to ensure seamless integration with existing systems and minimize operational risks.

- End-User Adoption: Educating investors about the benefits of security tokens, debunking myths and misconceptions, is essential to drive mass adoption and unlock the full potential of this transformative technology.

Bitbond: The Bridge Between Banks and Blockchain Technology

At Bitbond, we aim to stand at the forefront of bridging the gap between traditional financial institutions. With a proven track record of innovation and expertise, we empower financial institutions to seamlessly integrate tokenization technology into their operations to easily and cost-effectively issue security tokens and all types of tokenized assets. You can learn more about some of our most prominent reference uses cases here.

Our product Token Tool platform simplifies the process of tokenizing assets, ensuring compliance with regulatory requirements and seamless integration with existing systems. In 2019, we successfully issued the first security token in Germany, demonstrating our commitment to innovation and driving the adoption of security tokens in capital markets.

Conclusion: A Glimpse into the Future of Capital Markets

Security tokens are poised to transform capital markets, offering a transformative solution for enhanced liquidity, facilitating cross-border transactions, streamlining payments, and ensuring enhanced security and compliance. As regulatory frameworks evolve and technology matures, we are witnessing the dawn of a new era in financial markets, driven by the power of security tokens. This transformation will democratize access to investment opportunities, enhance global connectivity, and foster a more efficient and secure financial system, ushering in a new era of financial innovation.