Table of Contents

What is a Crypto Wallet?

With a non-custodial crypto wallet, you have complete control over your private keys, which control your cryptocurrency and prove ownership. Another party controls your private keys when you use a custodial wallet. Nowadays, the majority of custodial wallets are web-based exchange wallets.

The Benefits and Drawbacks of Custodial Crypto Wallets

The first time you buy cryptocurrency, it will almost certainly end up in a custodial exchange crypto wallet. The exchange in this case is your custodian, who holds your keys and is in charge of securely storing your funds. It is critical that you use a reputable custodial wallet, such as those provided by major cryptocurrency exchanges, where the majority of customer funds are held in cold storage hardware wallets that are highly secure. Find a list of top Web3 wallets offering custody solutions.

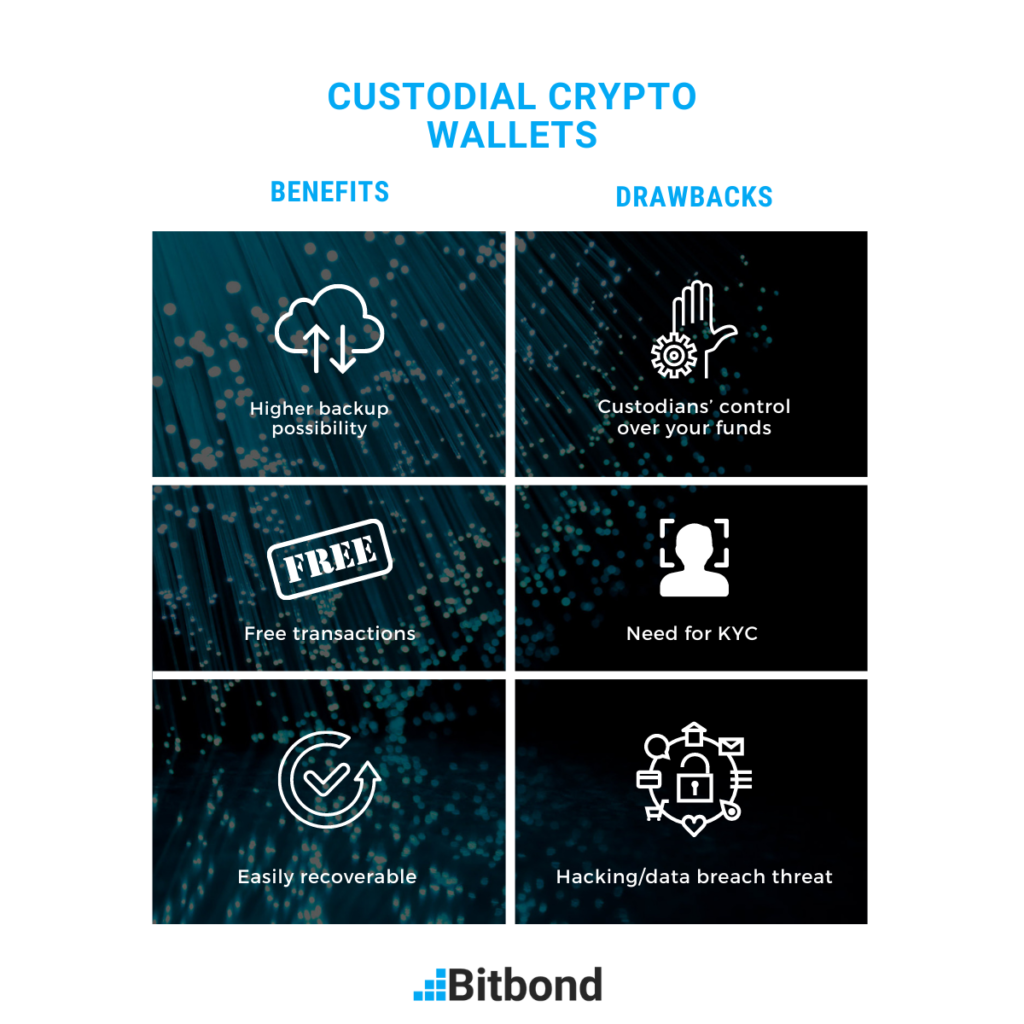

Recap of advantages and disadvantages of custodial crypto wallets

Benefits:

- Higher backup possibility

- Free transactions

- Easily recoverable

Drawbacks:

- Custodians’ control over your funds

- Need for KYC

- Hacking/data breach threat

- Fully online

While a custodial wallet is less secure than a non-custodial wallet, many people prefer them because they require less responsibility and are generally more convenient. If you do not take adequate precautions, losing your password to a non-custodial wallet could be financially disastrous. You won’t have to deal with anything like that if you use a custodial service. Should you lose your phone or break your laptop, your funds can still be recovered. Respecting the recommended security measures of your exchange almost guarantee you to be able to recover them.

Another benefit from using a custodial wallet is regarding the transaction fees. A processing fee must be paid each time a transaction is sent in the blockchain. The more you pay, the quicker the transaction will be completed. Some custodians allow their customers to send transactions within their ecosystem for free.

Finally, newer assets are gaining traction such as ETFs and ETP, particularly among institutional investors seeking greater exposure to cryptocurrency and tokens. They do charge higher fees and offer exposure to only a subset of cryptocurrencies and trading pairs available on exchanges. However, they provide a way to invest in crypto without having to manage keys or transac on the blockchain. This represents one of the solutions of the custodial wallets.

You have to be more responsible when using a non-custodial wallet

Non-custodial cryptocurrency wallets give you complete control over your keys and thus your funds. While some people store large amounts of cryptocurrency on exchange accounts, many people prefer a non-custodial wallet, which removes a third party from the equation.

Recap of advantages and disadvantages of non-custodial crypto wallets

Benefits:

- Control over funds

- Safety

- Instant withdrawals

Drawbacks:

- Trade delay

- More responsibility

- User interface (often more complicated)

- Lost key equals lost funds

While non-custodial wallets do not require you to trust a third party to keep your keys and crypto wallet safe, they do require you to trust yourself. You may lose access to your funds if you lose your crypto wallet, destroy it, or forget your password and haven’t taken precautions to recover it. Give no one physical access to your non-custodial cryptocurrency wallet. Your account could be drained without your knowledge if someone discovers your PIN or password.

Non-custodial wallets can be browser-based, software installed on mobile devices or desktop computers, or hardware devices, among other options. Although they can take many forms, hardware wallets are the most secure way to store your cryptocurrency. These crypto wallets are typically designed to resemble a USB storage device with a screen and analog buttons.

These hardware, non-custodial crypto wallets, which are turned off when not in use, must be connected to a computer or mobile device via USB ports or bluetooth to transact. Although they are technically connected to the internet during a transaction, the private keys sign the transaction offline within the hardware wallet before sending it online to the blockchain to be confirmed. As a result, when you use a non-custodial hardware wallet, even a malware-infected computer or phone cannot access your funds.

It All Comes Down to How You Want to Protect Your Crypto.

When it comes to securing your cryptocurrency holdings, deciding between a custodial wallet and a non-custodial wallet is critical. Some people prefer custodial exchange accounts, while others prefer non-custodial wallets, and still others use a mix of the two. You’ll also need to decide whether you want a hot or cold wallet, and whether you want to spread your cryptocurrency holdings across multiple crypto wallets. Whatever you choose, make sure to always adhere to best security practices.

Web3 comapnies offer the possibility to interact with service providers on blockchain while maintaining self-custody. Check out how to create a token on avax using our Token Tool. You can also easily deploy an ICO token sale script all while maintaining full ownership of the process.